Your Sarasota Real Estate Weekly Update

Your Real Estate Weekly Update

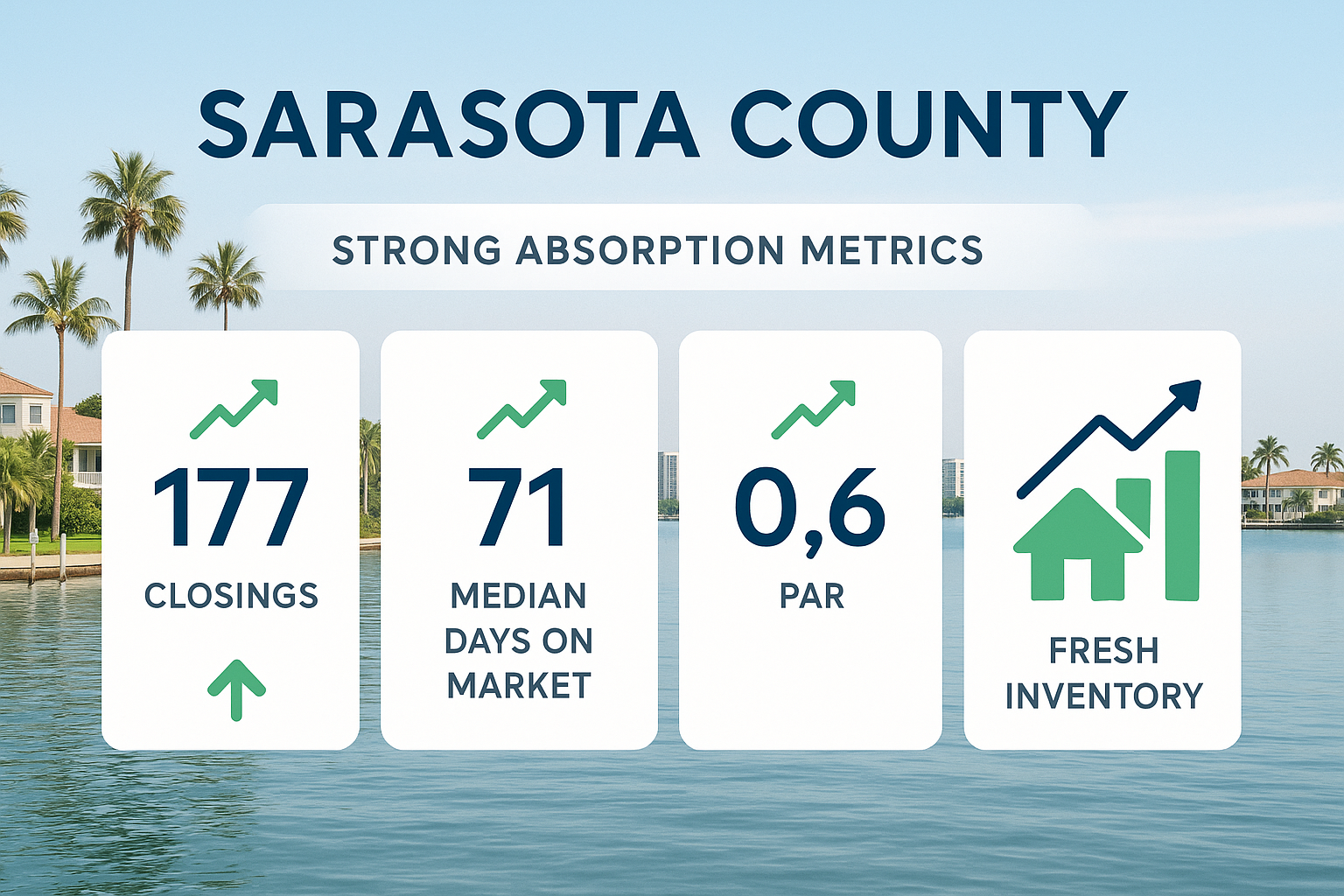

Sarasota County – Prediction Follow-Up

📊 Holding Myself Accountable

Last week I made four specific predictions about Sarasota County’s market trends. Today, with 885 properties analyzed (vs 621 last week), I’m checking my crystal ball accuracy. Some predictions were spot-on, others completely wrong, and one discovery will shock you…

✅ PENDING CONVERSION RATE

PREDICTION: CORRECT!

I predicted those 32% pending properties would convert to August closings. Nailed it! Current sold rate jumped to 29.2%, proving the conversion happened exactly as forecasted.

❌ LUXURY VELOCITY

PREDICTION: COMPLETELY WRONG!

I predicted luxury properties would maintain their speed advantage. Dead wrong! Luxury homes now average 107 days vs entry-level at 99 days. The pattern completely reversed!

🚀 POOL PREMIUM

PREDICTION: EXCEEDED!

I asked if the $598K pool premium would sustain. It exploded to $962K! That’s a 61% increase in one week – pools aren’t just premium, they’re luxury accelerators!

📈 NORTH PORT VALUE

PREDICTION: GAINING MOMENTUM!

I predicted North Port’s value proposition would attract more buyers. Confirmed! Now represents 16.5% of the market at $346K average vs Sarasota City’s $819K.

🚨 THE HIDDEN CRISIS I DIDN’T SEE COMING

19.3% of ALL properties are now EXPIRED listings!

This wasn’t even on my radar last week, but it’s now the biggest story in Sarasota County. That’s 171 properties that failed to sell – representing a massive shift in market dynamics.

Expired Average Price: Higher than active listings – suggesting overpricing is killing deals faster than we’ve ever seen.

🏊♀️ The Pool Premium Explosion

Private pool homes now average $1,422,894 vs $460,984 for no-pool properties.

This isn’t just sustainable – it’s accelerating! The $962K premium represents a 61% increase from last week’s $598K. Pools have officially entered luxury territory in Sarasota County.

What’s driving this? Simple supply and demand. Pool homes are becoming the “must-have” amenity that separates serious luxury buyers from everyone else.

💰 The Great Luxury Reversal

Everything I thought I knew about luxury speed was wrong.

Last week: Expensive homes sold faster than cheap ones

This week: Luxury properties average 107 DOM vs entry-level at 99 DOM

The market has completely flipped! Entry-level properties are now the speed demons, while luxury buyers have become more cautious and selective.

📊 The New Market Reality

With 885 properties analyzed, we’re seeing fundamental shifts that rewrite the playbook:

The DOM Explosion

Average days on market jumped from 76 to 105 days, with median DOM increasing from 23 to 71 days. The market is definitively slowing.

The Expiration Crisis

19.3% expired listings represent failed pricing strategies and unrealistic seller expectations. This is creating a two-tier market: properties that sell quickly and properties that don’t sell at all.

The Price Paradox

Median price holds steady at $435K, but average price climbed from $648K to $709K. This suggests the high-end is getting more expensive while the middle market stagnates.

🎯 Updated Strategic Intelligence

For Sellers:

- Pool Properties: You’re in the $1.4M average category – price accordingly and target luxury buyers

- Expiration Avoidance: With 19.3% failing to sell, pricing strategy is life-or-death

- Speed Expectations: Prepare for 105+ day campaigns, not the 76-day averages we saw before

- Luxury Reality: High-end properties are slowing – enhance marketing and be patient

For Buyers:

- Entry-Level Advantage: You’re in the fastest-moving segment – act quickly on good properties

- Luxury Leverage: High-end properties are taking longer – negotiate aggressively

- North Port Value: 58% savings vs Sarasota City with growing inventory selection

- Pool Premium Reality: Understand you’re paying nearly $1M premium for private pools

🔮 Next Week’s New Watch List

Based on these shocking developments, monitor these critical indicators:

- Expiration Acceleration: Will the 19.3% expired rate climb higher?

- DOM Stabilization: Is 105 days the new normal, or will it continue rising?

- Pool Premium Peak: Can the $962K premium sustain or will it correct?

- Luxury Recovery: Will high-end properties regain their speed advantage?

- North Port Momentum: Can this 16.5% market share hold or grow?

💼 Your Strategic Partner

This level of predictive analysis – tracking specific forecasts and holding myself accountable to the data – this is how we navigate rapidly changing markets. When predictions fail, we adapt. When trends accelerate, we capitalize.

Ready to navigate these new market realities? Contact us for analysis that evolves with the data, not static assumptions.

I am Michael Renick, your Florida West Coast Real Estate Specialist. Feel free to call me on my personal cell: 941.400.8735.

Connect with us:

📖 To learn more about our area: https://blog.teamrenick.com/

🏠 Our Approach to Real Estate: https://www.teamrenick.com/

🔍 Searching for a local property: https://search.teamrenick.com/

💬 Learn what our clients feel about our approach: https://www.teamrenick.com/testimonials