Manatee County Market Snapshot: October 19 – 25, 2025

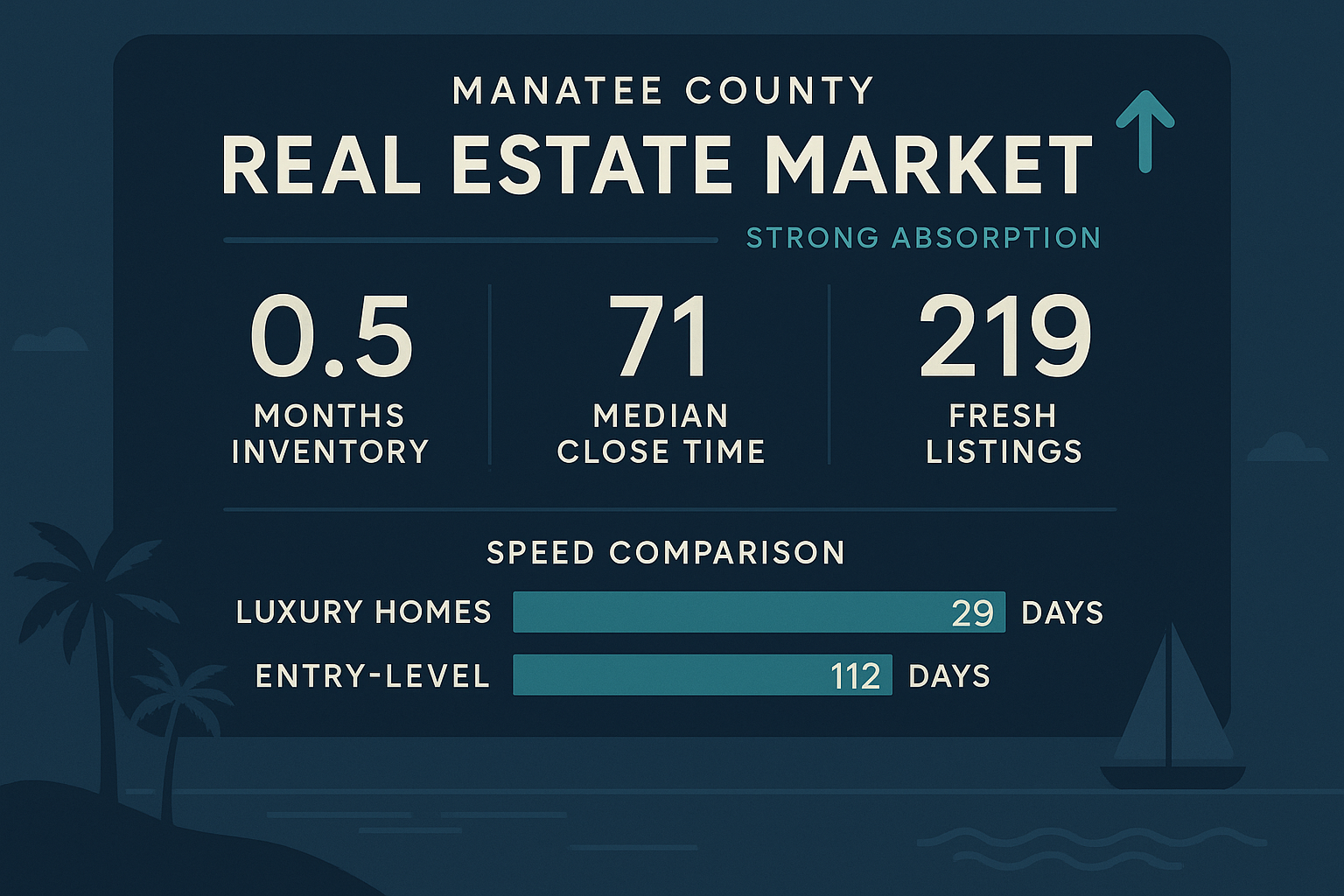

Manatee County Market Snapshot: October 19 – 25, 2025: Strong Absorption with 71-Day Median Close Times

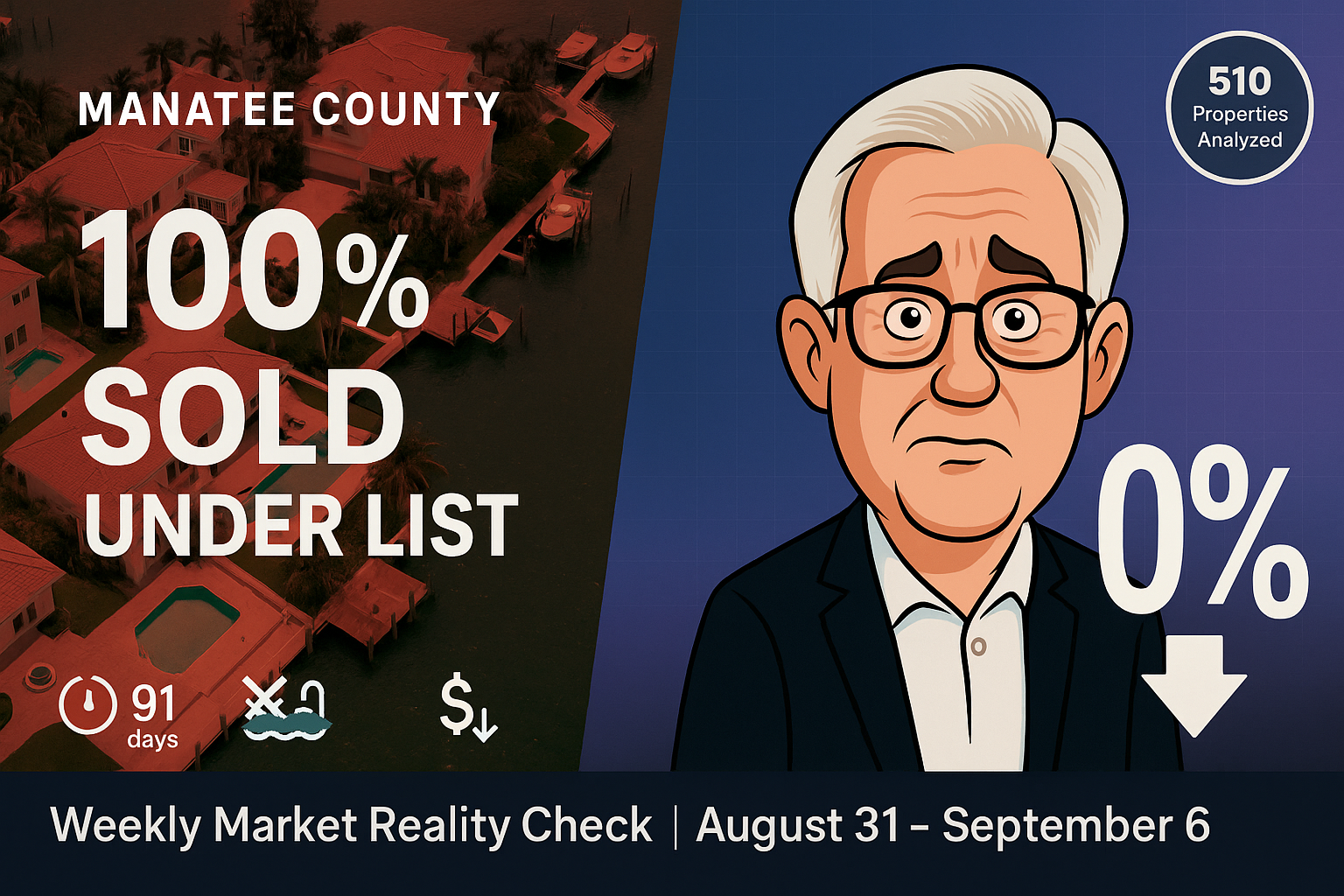

Analysis of 254 active, 182 pending, and 120 closed listings showing exceptional absorption with minimal inventory overhang.

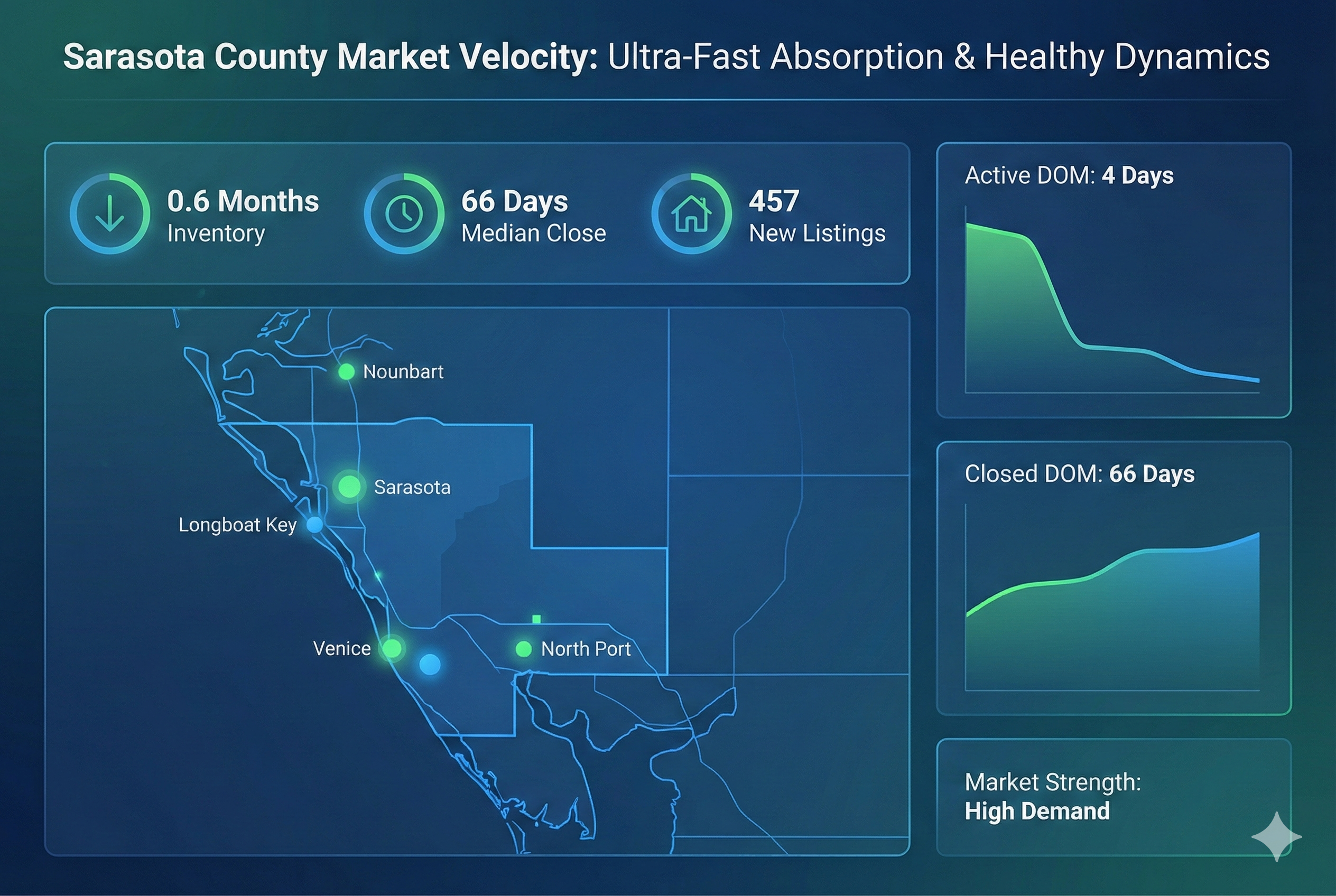

Market Snapshot: Strong seller’s market with 0.5 months sales inventory and luxury properties closing in 29 days.

All records analyzed

Segment Performance (Overall)

Price Bands

Clear price-speed inversion with luxury entry properties ($750K-$1M) closing in 29 days compared to 112.5 days for entry-level homes under $250K. Mid-tier properties ($250-500K) averaged 85 days, while upper-mid ($500-750K) closed in 54 days. This 288% speed advantage for luxury entry represents a significant market anomaly favoring higher-priced inventory.

Geography (Cities/Zips)

University Park achieved exceptional velocity at 1 day DOM, while Lakewood Ranch experienced extended 122-day marketing periods. Parrish and Palmetto performed efficiently at 52.5 and 53 days respectively. Bradenton and Sarasota showed moderate performance at 81.5 and 106 days. The 12,100% speed difference between University Park and Lakewood Ranch represents the most extreme geographic variation in the dataset.

Property Types

Single-family residences dominated with 89 closings at 67 days median. Condominiums achieved fastest velocity at 53.5 days across 14 transactions. Townhouses closed efficiently at 50 days for 5 sales, while villas required 151 days for 11 closings. The condo-hotel segment showed extended 200-day marketing with single transaction volume.

Segment Performance — Single-Family

Price Bands

Single-family luxury entry properties ($750K-$1M) closed in 26 days, significantly faster than mid-tier properties at 76 days. Upper-mid segment achieved 51-day velocity, while the single entry-level transaction required 319 days. This segment shows strong luxury preference with 89 total closings concentrated in mid-to-luxury tiers.

Geography (Cities/Zips)

University Park maintained exceptional 1-day performance for single-family homes. Lakewood Ranch single-family properties averaged 112 days, while Parrish and Palmetto achieved efficient 55 and 53-day closings respectively. Bradenton single-family homes closed in 72 days across 33 transactions, representing the largest geographic concentration.

Property Types

Single-family residences comprised the entire segment with 89 closings at 67 days median DOM and $485,000 median price. This category showed strong absorption with 0.84 PAR and 0.4 months sales inventory, indicating robust buyer demand for detached housing options.

Segment Performance — Condo/Townhome/Villa

Price Bands

Entry-level CTV properties closed in 66 days, while mid-tier required 124 days. Upper-mid segment showed extended 137.5-day marketing, with luxury entry achieving faster 32-day velocity. This segment demonstrated less consistent price-speed correlation compared to single-family homes.

Geography (Cities/Zips)

Parrish CTV properties achieved efficient 50-day closings, while Sarasota required 153 days. Bradenton CTV averaged 99 days across 17 transactions. Lakewood Ranch CTV showed extended 183-day marketing periods, significantly slower than the single-family segment in the same area.

Property Types

Condominiums led velocity at 53.5 days across 14 closings, while townhouses achieved 50-day efficiency for 5 transactions. Villas required significantly longer 151-day marketing across 11 closings. The single condo-hotel transaction needed 200 days, suggesting limited buyer interest in this property type.

Actionable Playbook

- Sellers: Price luxury properties ($750K+) aggressively as they move in 26-32 days, while entry-level sellers should prepare for 112+ day marketing periods and consider competitive pricing strategies.

- Buyers: Act quickly on luxury inventory given 29-day median closings, and focus on fresh listings under 7 days which comprise 86% of active inventory.

- Investors: Target single-family properties with 0.84 PAR and 0.4 months inventory for fastest liquidity, while avoiding villa segments with 151-day marketing periods.

- Consider geographic arbitrage between University Park’s 1-day velocity and Lakewood Ranch’s 122-day marketing periods for strategic positioning.

DOM Basis: CDOM

Notes: Pending-date coverage low (0%); strict in-window pending subset not used.

Period: October 19-25, 2025