Sarasota County Housing Brief: Nov 16–22

Sarasota County Market Snapshot: November 16 – 22, 2025: Strong Velocity with 53-Day Median Close Times

Analysis of 353 active, 223 pending, and 213 closed listings showing exceptional market velocity with balanced absorption.

Market Snapshot: Strong velocity market with 53-day median close times and minimal stale inventory at just 26 properties.

All records analyzed

Segment Performance (Overall)

Price Bands

Entry-level properties under $250K demonstrate fastest velocity at 36 days median close time with 29 transactions. Mid-tier properties ($250-500K) show solid performance at 44 days with the highest volume of 105 closings. A notable pattern emerges in luxury segments where luxury entry properties ($750K-$1M) require significantly longer at 163 days, while luxury properties ($1-1.5M) close much faster at 38.5 days, suggesting selective buyer behavior in premium segments.

Geography (Cities/Zips)

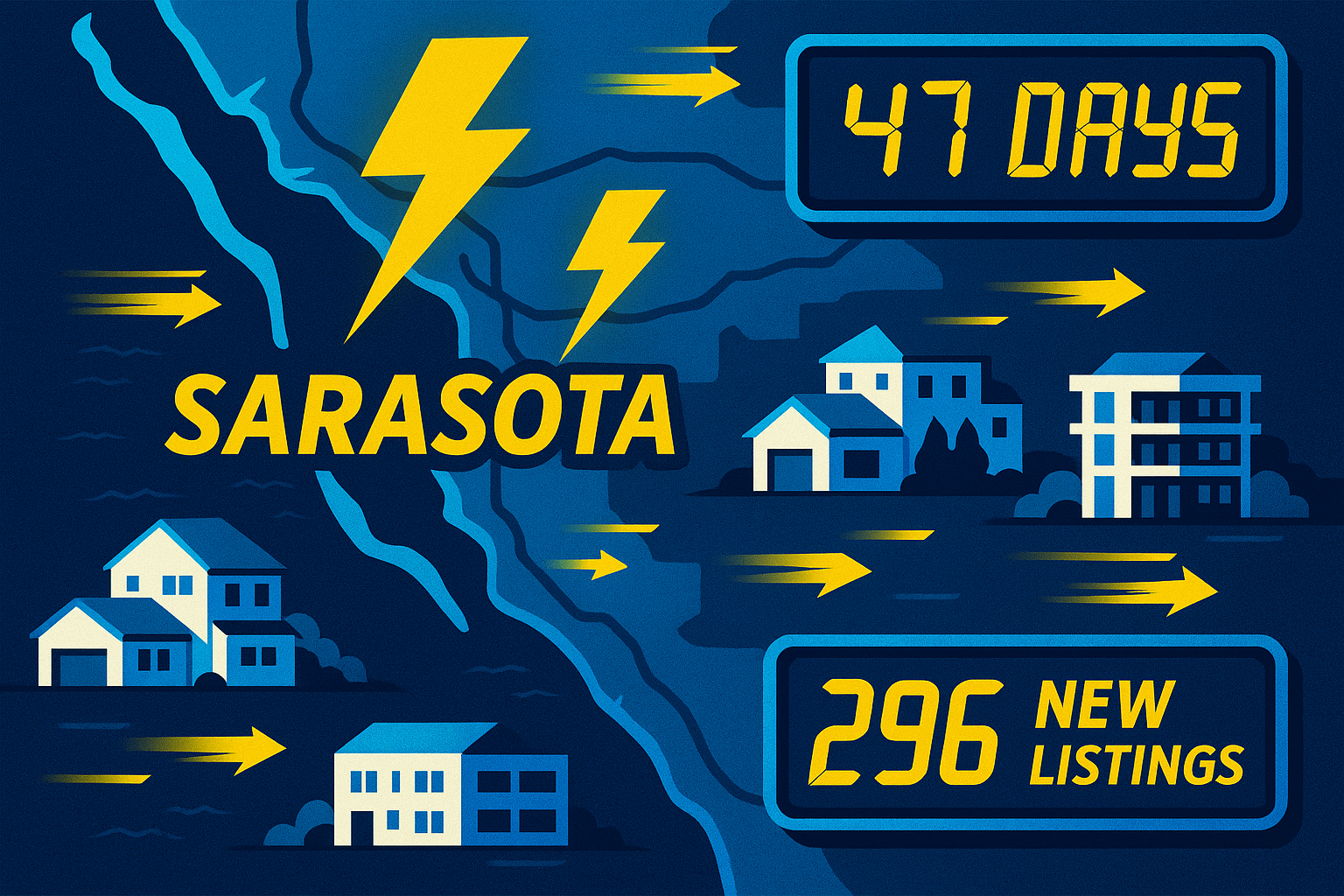

Geographic performance varies significantly across Sarasota County. Englewood leads with fastest closings at 31 days median, followed by North Port at 45.5 days and Nokomis at 47.5 days. Sarasota city shows moderate velocity at 57 days, while Venice requires 66.5 days. Longboat Key demonstrates premium market efficiency with 12 days median despite ultra-luxury pricing at $3.35M median. ZIP code analysis reveals 34291 and 34228 as standout performers with 2 and 12 days respectively.

Property Types

Property type performance shows villas leading velocity at 27 days median close time, followed by condominiums at 36 days. Townhouses require 58.5 days while single-family residences take 60 days. Single-family homes dominate transaction volume with 145 closings at $450,000 median price, while condominiums show strong affordability at $265,000 median with faster velocity.

Segment Performance — Single-Family

Price Bands

Single-family price bands show entry-level properties under $250K closing at 49.5 days with 10 transactions. Mid-tier properties ($250-500K) demonstrate strong performance at 48.5 days with 70 closings. The luxury entry segment ($750K-$1M) shows extended timelines at 147.5 days, while luxury properties ($1-1.5M) close significantly faster at 25 days, indicating selective premium market dynamics.

Geography (Cities/Zips)

Single-family geographic performance shows Englewood leading at 37 days median, followed by North Port at 47 days. Nokomis requires 64 days while Sarasota city and Venice show extended timelines at 68.5 and 72.5 days respectively. ZIP code 34232 demonstrates exceptional velocity at 5 days median, while 34291 shows 2 days median close time.

Property Types

Single-family residences represent the entire segment with 145 closings at $450,000 median price and 60 days median close time, demonstrating consistent performance across the category.

Segment Performance — Condo/Townhome/Villa

Price Bands

Condo/townhome/villa price bands show entry-level properties under $250K closing at 36 days with 19 transactions. Mid-tier properties ($250-500K) demonstrate superior velocity at 27 days with 35 closings. Upper-mid properties ($500-750K) require 52.5 days, while luxury segments show mixed performance with luxury entry at 264 days but luxury properties ($1-1.5M) closing at 52 days.

Geography (Cities/Zips)

Condo/townhome/villa geographic performance shows Longboat Key leading with 12 days median despite ultra-luxury pricing. Englewood follows at 18 days, while Venice shows strong velocity at 25.5 days. Sarasota city requires 43 days and Nokomis 47.5 days. ZIP code 34292 demonstrates exceptional performance at 3 days median close time.

Property Types

Villas lead with 27 days median close time at $342,000 median price with 23 transactions. Condominiums follow at 36 days with $265,000 median price and 37 closings. Townhouses require 58.5 days at $312,000 median price with 8 transactions, showing the longest timeline in this category.

Actionable Playbook

- Sellers: Price competitively in entry and mid-tier segments for fastest velocity, with luxury entry properties requiring strategic positioning due to extended 163-day timelines.

- Buyers: Focus on Englewood and North Port for fastest closings, while Venice may offer more selection with longer timelines.

- Investors: Target condo/villa segment for superior velocity at 34.5 days versus single-family at 60 days, particularly in Longboat Key and Englewood markets.

- Consider entry-level properties under $250K for consistent 36-day performance across all property types.

DOM Basis: CDOM

Notes: Pending-date coverage low (0%); strict in-window pending subset not used.

Period: November 16-22, 2025

For expert updates on the Florida West Coast real estate market, contact Michael Renick — your dedicated specialist.