Manatee County Housing Update: Nov 16–22

Manatee County Market Snapshot: November 16 – 22, 2025: Two-Speed Market with 62-Day Single-Family Closings

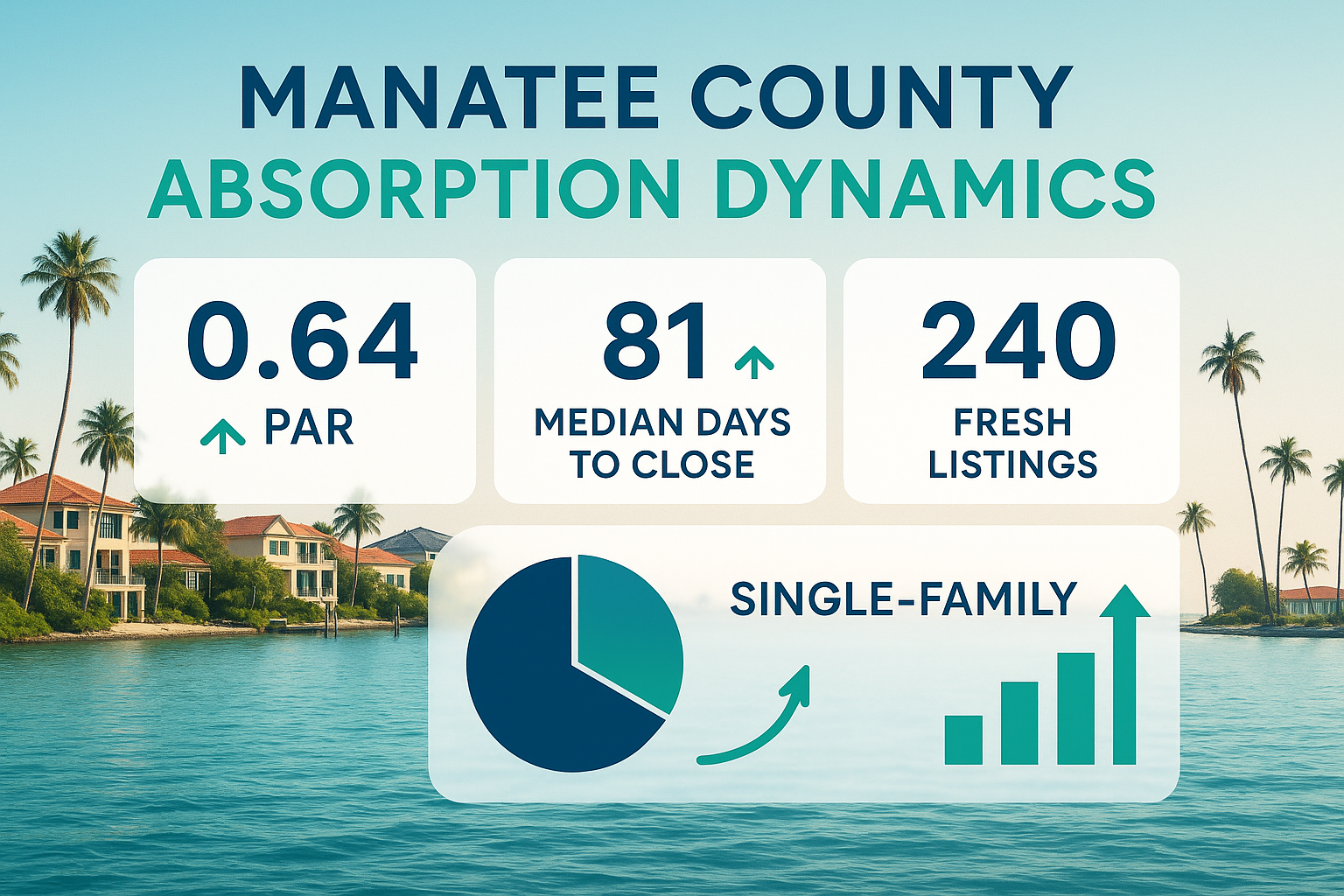

Analysis of 268 active, 179 pending, and 210 closed listings showing distinct two-speed performance between property types.

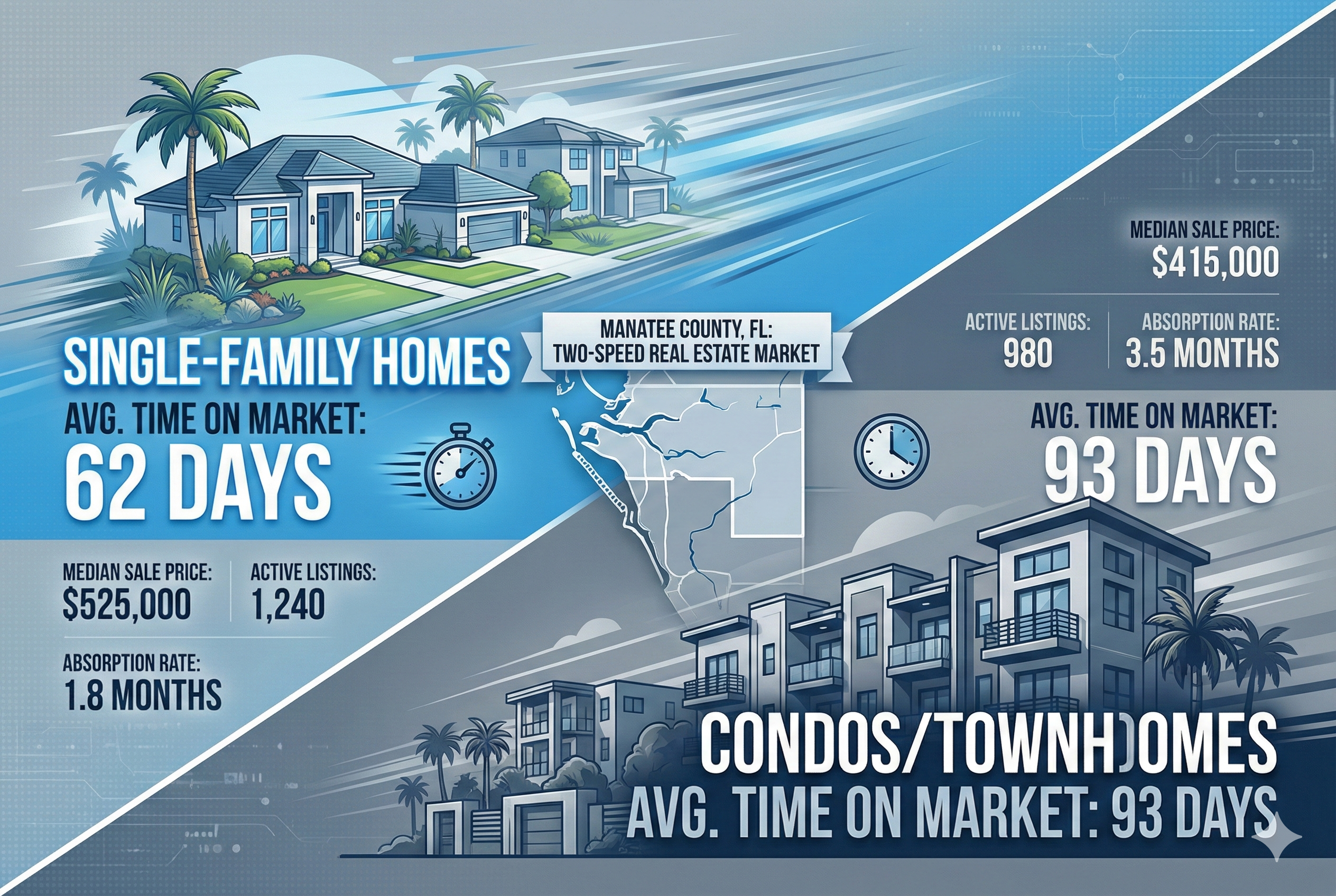

Market Snapshot: Single-family homes close 31 days faster than condos/villas, creating clear two-speed market dynamics.

All records analyzed

Segment Performance (Overall)

Price Bands

Mid-tier properties ($250-500K) demonstrate strongest velocity at 64 days across 109 closings. Entry-level homes (<$250K) close in 70 days with 21 sales. Upper-mid segment ($500-750K) shows 72.5 days with 48 closings. Luxury entry ($750K-1M) slows significantly to 111 days across 15 sales, while luxury properties ($1-1.5M) close in 95 days with 12 transactions. Ultra-luxury and super-luxury segments show limited activity with 1 and 4 closings respectively.

Geography (Cities/Zips)

Sarasota leads with 44-day closings across 9 transactions, significantly faster than the market median. Palmetto follows at 57.5 days with 24 closings. Bradenton, the dominant market with 88 closings, maintains steady 70-day performance. Parrish shows 68 days across 45 sales. Beach communities demonstrate seasonal patterns: Longboat Key at 140 days (5 closings) and Holmes Beach at 121.5 days (6 closings). Lakewood Ranch shows 88 days across 24 premium transactions.

Property Types

Single-family residences dominate with 147 closings at 62 days median. Condominiums follow with 34 closings at 76 days. Villas show the slowest performance at 141.5 days across 16 transactions. Townhouses close in 68 days with 13 sales. The performance gap between single-family homes and villas represents a 79.5-day difference, highlighting strong buyer preference for detached housing.

Segment Performance — Single-Family

Price Bands

Single-family mid-tier ($250-500K) shows exceptional velocity at 53 days across 72 closings. Upper-mid segment ($500-750K) closes in 69 days with 42 transactions. Luxury entry ($750K-1M) slows to 111 days across 15 sales. The luxury segment ($1-1.5M) shows 95 days with 12 closings. Entry-level single-family shows limited activity with only 1 closing at 470 days, indicating minimal inventory in this segment.

Geography (Cities/Zips)

Bradenton leads single-family activity with 52 closings at 51.5 days. Parrish shows 38 closings at 66 days. Palmetto demonstrates 22 closings at 57.5 days. Sarasota maintains strong performance with 6 closings at 51.5 days. Lakewood Ranch shows 16 premium closings at 64 days. Beach communities show expected seasonal patterns with Holmes Beach at 170 days and Anna Maria at 165 days.

Property Types

Single-family residences represent the entire category with 147 closings at 62 days median, demonstrating consistent performance across the segment with strong buyer demand and efficient market clearing.

Segment Performance — Condo/Townhome/Villa

Price Bands

Entry-level condos/townhomes (<$250K) show 68.5 days across 20 closings. Mid-tier segment ($250-500K) slows to 97 days with 37 transactions. Upper-mid properties ($500-750K) demonstrate 119 days across 6 closings. The attached housing market shows consistently slower performance compared to single-family homes across all price bands.

Geography (Cities/Zips)

Bradenton dominates with 36 closings at 102 days. Lakewood Ranch shows 8 closings at 126 days. Longboat Key demonstrates 4 closings at 119 days for luxury condos. Parrish shows 7 closings at 68 days. Sarasota maintains 3 closings at 34 days, significantly faster than other markets in this category.

Property Types

Villas show the slowest performance at 141.5 days across 16 closings. Condominiums close in 76 days with 34 transactions. Townhouses demonstrate 68 days across 13 sales, performing best within the attached housing category but still slower than single-family homes.

Two-Speed Market

Clear two-speed dynamics emerge with single-family homes closing in 62 days versus condos/townhomes/villas at 93 days. This 31-day gap represents a 50% speed difference, indicating strong buyer preference for detached housing. Single-family absorption (PAR 0.71) significantly exceeds attached housing (PAR 0.59).

Actionable Playbook

- Sellers: Price single-family homes competitively in the $250-500K range for 53-day closings; expect 93+ days for condos/villas

- Buyers: Focus on single-family options for faster closings; consider attached housing for potentially better pricing with longer timelines

- Investors: Target mid-tier single-family properties for optimal velocity; avoid luxury entry segment showing 111-day closings

- Monitor Sarasota and Palmetto markets for fastest geographic performance across property types

DOM Basis: CDOM

Notes: Pending-date coverage low (0%); strict in-window pending subset not used.

Period: November 16-22, 2025

For expert updates on the Florida West Coast real estate market, contact Michael Renick — your dedicated specialist.