Manatee County Market: Nov 23–29 Highlights

Manatee County Market Snapshot: November 23 – 29, 2025: Two-Speed Market with 56-Day Gap Between Active and Closed Inventory

Analysis of 187 active, 121 pending, and 145 closed listings showing pronounced velocity differences between current and recently sold inventory.

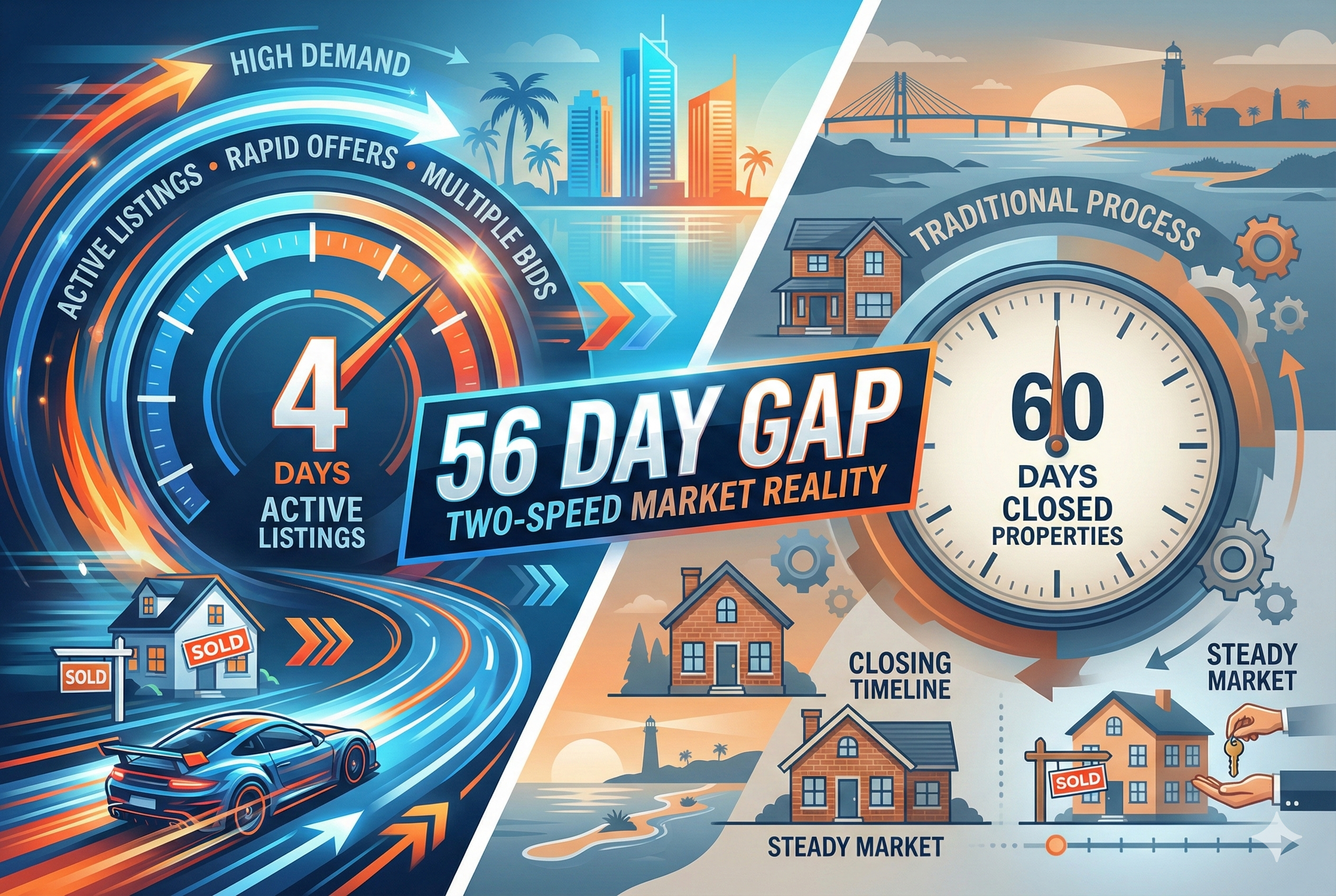

Market Snapshot: Active listings show 4-day median DOM while closed properties averaged 60 days, creating a 56-day velocity gap indicating significant market acceleration.

All records analyzed

Segment Performance (Overall)

Price Bands

Mid-tier properties (250-500K) demonstrated strongest velocity with 52-day median DOM across 73 transactions. Entry-level homes under 250K required 103 days despite lower pricing, while Upper-Mid properties (500-750K) took 99.5 days. Luxury Entry properties (750K-1M) moved quickly at 32 days across 14 sales, but the single Super-Luxury transaction required 283 days, indicating selective buyer behavior at the highest price points.

Geography (Cities/Zips)

Myakka City emerged as the velocity leader with 11-day median DOM across 3 transactions, while Parrish showed strong performance at 48.5 days across 32 closings. Palmetto and Lakewood Ranch maintained moderate timelines at 52 and 66 days respectively. Ellenton significantly lagged at 168 days, and Bradenton Beach showed extended timelines at 141.5 days. The geographic spread indicates location-specific demand patterns with rural and emerging areas showing faster absorption than established coastal markets.

Property Types

Single-family residences dominated with 109 transactions at 55-day median DOM, significantly outpacing condominiums at 75 days across 22 sales. Townhouses required 81 days across 9 transactions, while villas showed the longest timeline at 129 days across 5 sales. The property type hierarchy clearly favors detached homes, with attached and shared-wall properties experiencing progressively longer market times.

Segment Performance — Single-Family

Price Bands

Single-family Mid-tier properties (250-500K) led with 53-day median DOM across 52 transactions. Luxury Entry homes (750K-1M) moved quickly at 32 days, while Upper-Mid properties required 92 days. Entry-level single-family homes showed 71-day timelines across limited volume. The luxury tiers maintained strong velocity with Luxury properties (1-1.5M) closing in 50.5 days, though the single Super-Luxury home required 283 days.

Geography (Cities/Zips)

Myakka City led single-family velocity at 11 days, while Parrish maintained strong performance at 48.5 days across 28 transactions. Palmetto showed 52-day timelines across 17 sales. Ellenton significantly lagged at 168 days, and the single Bradenton Beach luxury transaction required 283 days. Geographic patterns within single-family homes mirror overall market trends with emerging areas outperforming established coastal locations.

Property Types

Single-family residences comprised the entire segment with 109 transactions at 55-day median DOM, demonstrating consistent buyer preference for detached homes across all price points and geographic areas within this category.

Segment Performance — Condo/Townhome/Villa

Price Bands

Mid-tier CTV properties (250-500K) showed strongest performance at 45-day median DOM across 21 transactions. Entry-level properties under 250K required 113 days across 14 sales, indicating price sensitivity in the attached home market. The single Upper-Mid property took 130 days, suggesting limited demand in higher-priced CTV segments.

Geography (Cities/Zips)

Lakewood Ranch led CTV performance at 52-day median DOM across 8 transactions, while Parrish showed 63-day timelines across 4 sales. Bradenton required 105 days across 18 transactions, and Sarasota lagged significantly at 175 days. The geographic patterns suggest master-planned communities outperform traditional urban CTV markets.

Property Types

Condominiums led the CTV segment with 75-day median DOM across 22 transactions, followed by townhouses at 81 days across 9 sales. Villas showed the longest timelines at 129 days across 5 transactions, indicating buyer preference hierarchy within attached housing options.

Two-Speed Market

The market exhibits a pronounced two-speed dynamic with active listings showing 4-day median DOM while closed properties averaged 60 days – a 56-day gap that significantly exceeds the 30-day threshold. This indicates substantial acceleration in current market velocity compared to recently completed transactions, suggesting either seasonal effects or fundamental market shift toward faster absorption.

Actionable Playbook

- Sellers: Price competitively in Mid-tier (250-500K) segment for fastest absorption at 52 days, and consider emerging markets like Myakka City and Parrish for accelerated timelines.

- Buyers: Focus on single-family homes for best selection with 55-day median timelines, and explore CTV options in Lakewood Ranch for attached housing with reasonable 52-day absorption.

- Investors: Target Mid-tier properties for quickest turnover, avoid Entry-level CTV properties showing 113-day timelines, and monitor the velocity gap for market timing opportunities.

- Monitor the 56-day velocity gap between active and closed inventory as an early indicator of market direction changes and pricing power shifts.

DOM Basis: CDOM

Notes: Pending-date coverage low (0%); strict in-window pending subset not used.

Period: November 23-29, 2025