Sarasota County Housing Update Nov 30–Dec 6

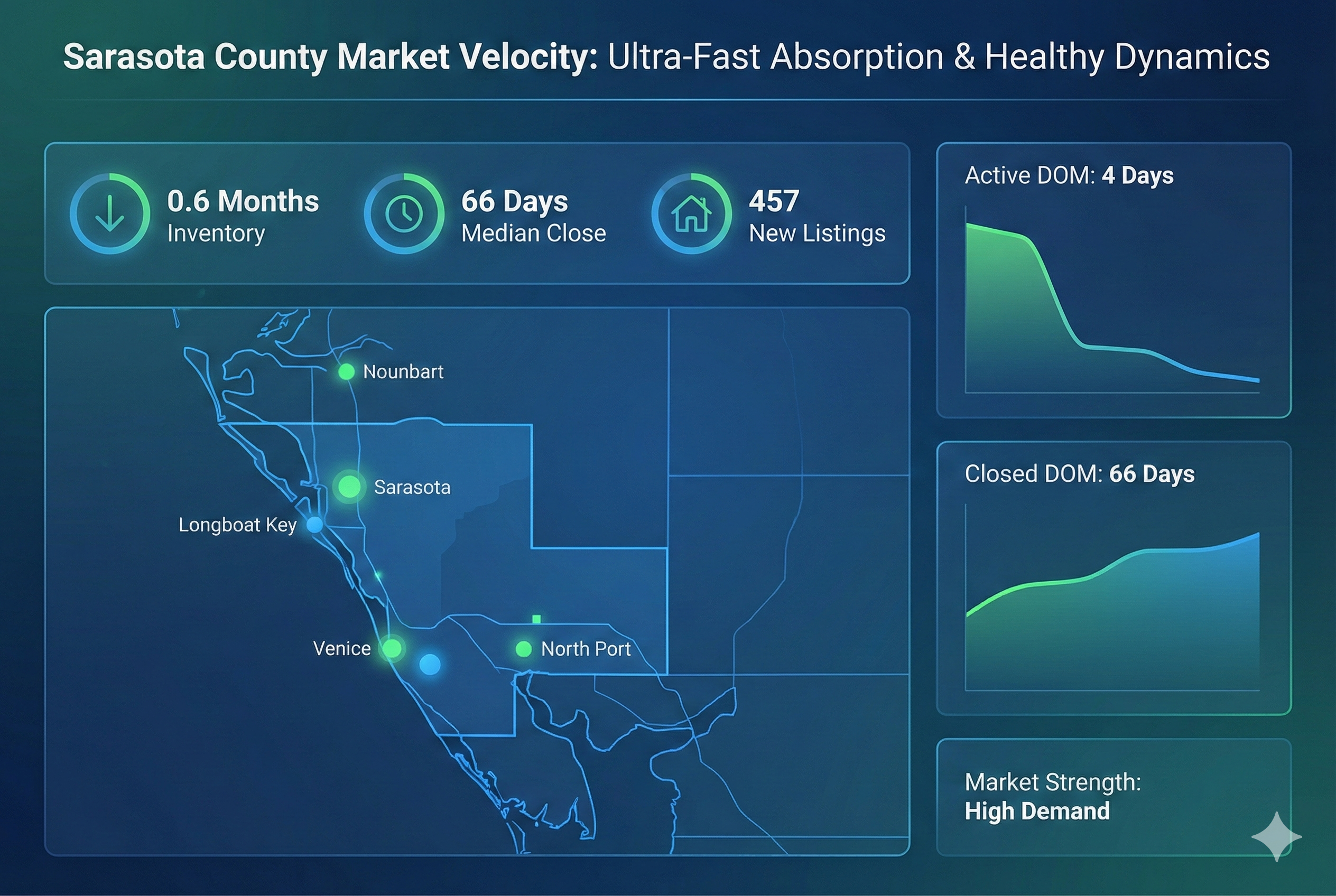

Sarasota County Market Snapshot: November 30 – December 6, 2025: Ultra-Fast Absorption with 66-Day Median Close Times

Analysis of 505 active, 209 pending, and 209 closed listings showing exceptional absorption dynamics with rapid property turnover.

Market Snapshot: Ultra-fast absorption with just 0.6 months inventory and 66-day median close times across all property types.

All records analyzed

Segment Performance (Overall)

Price Bands

Price band performance shows notable variations across segments. Entry-level properties under $250K (25 closings) averaged 68 days to close at $187,000 median. Mid-market properties ($250-500K) dominated with 98 closings at 62 days median DOM and $366,250 median price. Upper-mid segment ($500-750K) showed 42 closings at 74 days and $589,319 median. Luxury entry ($750K-1M) had 18 closings at 65 days. The luxury segment ($1-1.5M) demonstrated exceptional velocity with just 16 days median DOM across 9 closings at $1,300,000 median. Ultra-luxury properties ($1.5-2M) took significantly longer at 200 days across 7 closings, while super-luxury properties (2M+) closed in 49 days across 10 transactions at $3,795,000 median.

Geography (Cities/Zips)

Geographic performance varies significantly across Sarasota County. Englewood leads in transaction speed with 14 closings at 34.5 days median DOM and $350,000 median price. Sarasota dominates volume with 93 closings at 66 days median DOM and premium pricing at $495,000 median. Venice follows with 49 closings at 68 days and $375,000 median. North Port shows 32 closings at 75.5 days and $340,495 median. Longboat Key demonstrates luxury market strength with 5 closings at just 16 days median DOM and $1,450,000 median price. ZIP code analysis reveals 34223 (Englewood) leading in speed at 34.5 days, while 34228 (Longboat Key) shows premium luxury performance at 16 days and $1,450,000 median.

Property Types

Property type performance shows clear differentiation in market velocity. Single-family residences dominate with 145 closings at 63 days median DOM and $489,000 median price. Condominiums show 40 closings but take significantly longer at 111.5 days median DOM with $307,563 median price. Villas demonstrate strong performance with 21 closings at just 39 days median DOM and $360,000 median price. Townhouses represent the smallest segment with 3 closings at 100 days median DOM and $299,000 median price. The data reveals villas as the fastest-moving attached property type, while condominiums require the longest marketing time.

Segment Performance — Single-Family

Price Bands

Single-family price bands show strong performance across most segments. Entry-level properties under $250K had 6 closings at 75.5 days median DOM. The mid-market ($250-500K) dominated with 68 closings at 58.5 days and $372,134 median price. Upper-mid properties ($500-750K) showed 35 closings at 68 days median DOM. Luxury entry ($750K-1M) had 16 closings at 65 days. The luxury segment ($1-1.5M) demonstrated exceptional speed with 6 closings at 35.5 days median DOM. Ultra-luxury properties ($1.5-2M) took 200 days across 5 closings, while super-luxury homes (2M+) closed in 66 days across 9 transactions at $4,100,000 median price.

Geography (Cities/Zips)

Single-family geographic performance shows Sarasota leading with 63 closings at 55 days median DOM and $699,958 median price. North Port follows with 32 closings at 75.5 days and $340,495 median. Venice shows 28 closings at 84.5 days median DOM. Englewood demonstrates exceptional speed with 8 closings at just 21 days median DOM. Longboat Key shows ultra-luxury performance with 1 closing at 1 day DOM and $3,490,000 price. ZIP code analysis reveals 34228 (Longboat Key) leading in speed at 1 day, while 34287 shows the longest time at 255 days median DOM.

Property Types

Single-family residences represent the entire segment with 145 closings at 63 days median DOM and $489,000 median price, demonstrating consistent performance across the category.

Segment Performance — Condo/Townhome/Villa

Price Bands

Condo/townhome/villa price bands show varied performance patterns. Entry-level properties under $250K had 19 closings at 68 days median DOM and $180,000 median price. Mid-market properties ($250-500K) showed 30 closings at 73.5 days median DOM. Upper-mid segment ($500-750K) demonstrated slower velocity with 7 closings at 142 days median DOM. Luxury entry properties ($750K-1M) took 163 days across 2 closings. The luxury segment ($1-1.5M) showed strong performance with 3 closings at just 16 days median DOM and $1,400,000 median price. Ultra-luxury properties ($1.5-2M) required 152.5 days across 2 closings, while the super-luxury segment had 1 closing at 32 days.

Geography (Cities/Zips)

Condo/townhome/villa geographic performance shows Venice leading with 21 closings at 39 days median DOM and $318,000 median price. Sarasota follows with 30 closings at 82.5 days median DOM and $395,000 median price. Englewood shows 6 closings at 74.5 days median DOM. Longboat Key demonstrates luxury performance with 4 closings at 120 days median DOM and $1,425,000 median price. ZIP code analysis reveals 34292 leading in speed at 29.5 days median DOM, while 34234 shows the longest time at 319 days.

Property Types

Property type performance within the condo/townhome/villa segment shows clear differentiation. Condominiums represent the largest segment with 40 closings but require the longest time at 111.5 days median DOM and $307,563 median price. Villas demonstrate superior velocity with 21 closings at just 39 days median DOM and $360,000 median price. Townhouses show 3 closings at 100 days median DOM and $299,000 median price.

Actionable Playbook

- Sellers: Price competitively in the mid-market segment where 98 properties closed in 62 days, and consider villa conversions which move fastest at 39 days median DOM.

- Buyers: Focus on fresh inventory with 457 new listings under 7 days, and consider condos for value opportunities despite longer 111.5-day marketing times.

- Investors: Target Englewood for quick turnover at 34.5 days median DOM, and monitor luxury properties ($1-1.5M) showing exceptional 16-day velocity.

- Monitor ultra-luxury segment carefully as properties over $1.5M show extended marketing times of 200 days, requiring patient capital and strategic positioning.

DOM Basis: CDOM

Notes: Pending-date coverage low (0%); strict in-window pending subset not used.

Period: November 30 – December 6, 2025