Manatee County Weekly Report: Dec 14–20

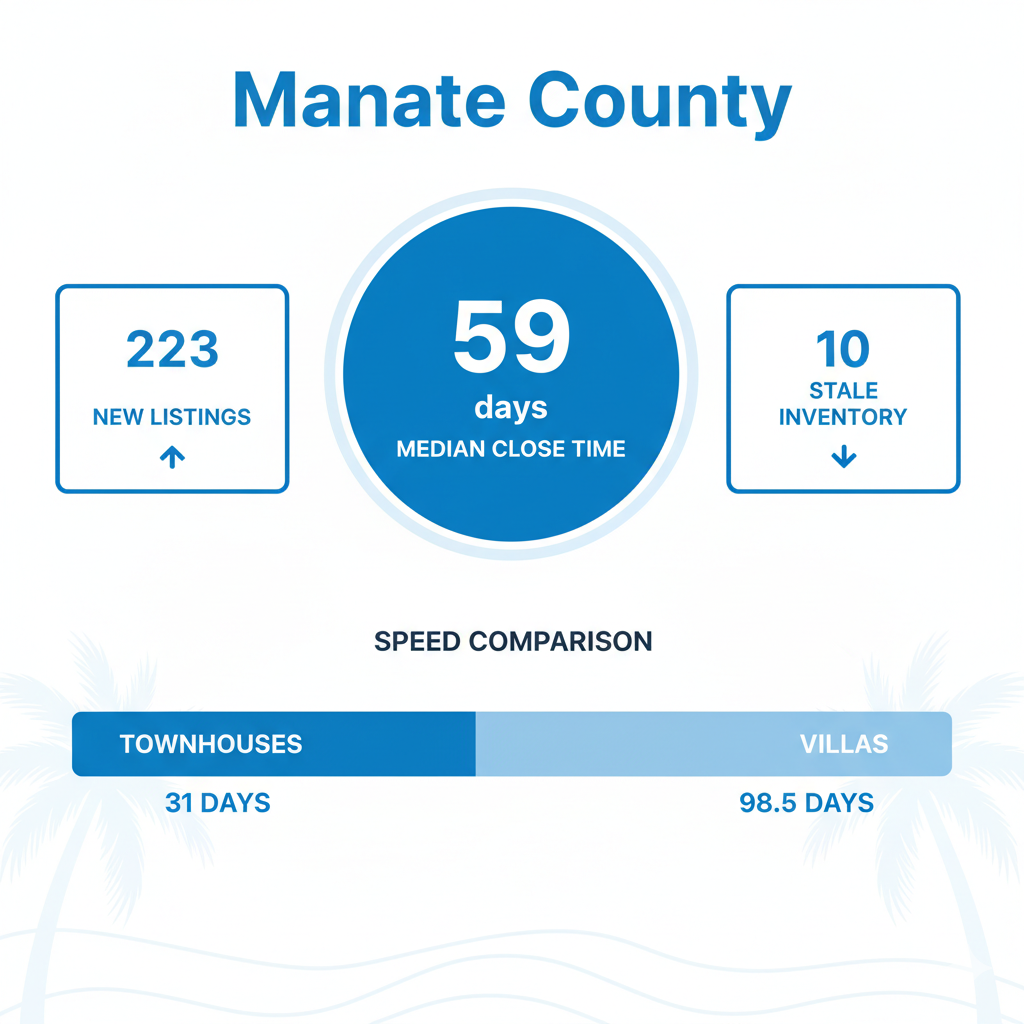

Manatee Market Snapshot: December 14 – 20, 2025: Fast-Moving Market with 66-Day Median Close Times

Analysis of 241 active, 140 pending, and 180 closed listings showing exceptional velocity with ultra-fresh inventory.

Market Snapshot: Manatee County demonstrates remarkable market velocity with 66-day median close times and active listings averaging just 3 days on market.

All records analyzed

Segment Performance (Overall)

Price Bands

Price band analysis reveals significant performance variations. Entry-level properties under $250K showed extended marketing times at 141 days median DOM with 22 closings. Mid-tier properties ($250-500K) dominated activity with 88 closings at 57 days median DOM. Upper-mid properties ($500-750K) closed in 67 days with 43 transactions. The luxury entry tier ($750K-1M) experienced slower absorption at 106 days with 11 closings. Notably, luxury properties ($1-1.5M) moved fastest at just 18 days with 5 closings, while ultra-luxury ($1.5-2M) closed in 37 days and super-luxury (2M+) took 100 days.

Geography (Cities/Zips)

Bradenton led market activity with 91 closings at 50 days median DOM. Parrish followed with 33 closings at 52 days, while Lakewood Ranch recorded 21 closings at 88 days. Coastal markets showed extended timelines: Anna Maria averaged 273 days with 3 closings, Bradenton Beach also at 274 days with 2 closings, and University Park at 165 days with 3 closings. Holmes Beach performed better among coastal areas at 81 days with 5 closings. ZIP code analysis shows 34203 (Bradenton) performing exceptionally at 30 days median DOM, while coastal ZIP 34216 (Anna Maria) and 34217 (Holmes Beach/Bradenton Beach) averaged significantly longer marketing periods.

Property Types

Single-family residences dominated with 132 closings at 63 days median DOM and $512,539 median price. Condominiums recorded 29 closings with slower absorption at 84 days and lower median price of $237,500. Villas showed strong performance with 10 closings at 47 days median DOM and $348,618 median price. Townhouses recorded 9 closings at 64 days with $270,000 median price. The data shows villas moving fastest, followed by single-family homes, then townhouses and condominiums.

Segment Performance — Single-Family

Price Bands

Single-family price bands show distinct patterns. Entry-level properties under $250K had minimal activity with 3 closings at 7 days median DOM. Mid-tier properties ($250-500K) led with 61 closings at 58 days. Upper-mid properties ($500-750K) recorded 41 closings at 67 days. Luxury entry ($750K-1M) showed 11 closings at 106 days. The luxury tier ($1-1.5M) moved fastest at 18 days with 5 closings, ultra-luxury ($1.5-2M) at 37 days with 5 closings, and super-luxury (2M+) at 100 days with 6 closings.

Geography (Cities/Zips)

Bradenton led single-family activity with 59 closings at 38 days median DOM. Parrish recorded 26 closings at 54 days, while Lakewood Ranch had 17 closings at 88 days. Coastal markets showed extended timelines: Anna Maria at 273 days with 3 closings and University Park at 165 days with 3 closings. Holmes Beach performed better at 81 days with 5 closings. ZIP code performance varied significantly, with 34203 showing exceptional speed at 30 days and coastal areas like 34216 averaging 273 days.

Property Types

Single-family residences comprised all 132 closings in this category with 63 days median DOM and $512,539 median price at $251 per square foot.

Segment Performance — Condo/Townhome/Villa

Price Bands

Condo/townhome/villa price bands showed concentrated activity in lower tiers. Entry-level properties under $250K recorded 19 closings with extended 176 days median DOM. Mid-tier properties ($250-500K) had 27 closings at 51 days median DOM. Upper-mid properties ($500-750K) showed minimal activity with 2 closings at 64 days. Higher price bands had no recorded activity in this category.

Geography (Cities/Zips)

Bradenton dominated with 32 closings at 73 days median DOM. Parrish recorded 7 closings at 51 days, while Lakewood Ranch had 4 closings at 118 days. Coastal areas showed extended marketing times: Bradenton Beach at 274 days with 2 closings and Longboat Key at 147 days with 2 closings. ZIP code analysis reveals 34202 performing well at 19 days, while coastal ZIP 34217 averaged 274 days.

Property Types

Condominiums led with 29 closings at 84 days median DOM and $237,500 median price. Villas recorded 10 closings at 47 days with $348,618 median price. Townhouses had 9 closings at 64 days with $270,000 median price. Villas demonstrated the fastest absorption in this category.

Actionable Playbook

- Sellers: Price competitively in the mid-tier ($250-500K) range for fastest absorption at 57 days, while luxury properties ($1-1.5M) show exceptional velocity at 18 days.

- Buyers: Focus on Bradenton and Parrish for best selection with reasonable marketing times, while coastal properties offer opportunities with extended DOM.

- Investors: Target entry-level condos and villas in Bradenton area, avoiding coastal markets with extended absorption periods.

- Consider villa properties for fastest CTV absorption at 47 days versus condos at 84 days.

DOM Basis: CDOM

Notes: Pending-date coverage low (0%); strict in-window pending subset not used.

Period: December 14-20, 2025