Barrier Islands Housing Insights and Key Data

What Are the Key Housing Market Trends for the Barrier Islands in 2025?

Quick Answer

- Expect moderate price growth, but with fluctuations due to seasonal demand.

- Inventory remains tight in Sarasota and Manatee counties, tightening competition.

- Flood insurance rates in zones AE and VE could impact affordability.

- Watch for HOA and condo restrictions before placing offers.

- Connect with local experts to understand elevation certificates and wind mitigation needs.

- For the latest information contact Michael Renick, a Florida West Coast Real Estate Specialist.

The Complete Picture

The real estate landscape on Florida’s Barrier Islands, including Longboat Key, Siesta Key, and Anna Maria Island, is ever-evolving. In 2025, local and incoming buyers and sellers need to navigate a market influenced by both natural beauty and regulatory complexities. Understanding the specifics of this market can make the difference between securing your dream property and facing unexpected challenges.

Eric Teoh sets himself apart as a world-class agent. While staying attuned to our “wish list” for the perfect property, he demonstrated vast knowledge of the Longboat Key real estate market, including market valuations and trends. Eric is highly responsive to every inquiry. He works effectively with counter-parties and other professionals, including through negotiations and closing. Eric works tirelessly. He puts his client’s interests first!

– Samuel Isaacson, Google Review

[Market Reality]

As of 2025, Florida’s Barrier Islands are showing moderate price growth due to persistent high demand from out-of-state buyers, especially those relocating from higher-tax states. Average days on market (DOM) are lower compared to mainland Sarasota and Manatee counties, indicating a competitive landscape. Inventory remains constrained, especially for waterfront properties. However, flood insurance is a significant factor; rising rates linked to FEMA’s Risk Rating 2.0 could affect affordability, especially in flood-prone zones AE and VE. It’s crucial to account for these insurance costs when budgeting.

[Local Insights]

Longboat Key and Siesta Key offer unique attractions but come with lifestyle trade-offs, such as bridge traffic and limited access during peak tourist seasons. Longboat Key’s HOA/condo regulations can be stringent, particularly regarding exterior changes and rentals. On Anna Maria Island, rental opportunities and management rules are more flexible, but require due diligence. Elevation certificates are essential documents for potential buyers, impacting flood insurance premiums. Local building codes focus heavily on wind mitigation due to hurricane risk—a reality all buyers must consider.

[Buyer‘s Guide]

For buyers, securing financing early is essential. Pre-approval gives you an edge in fast-moving markets. Pay close attention to inspection contingencies, especially related to flood and wind damage. The overall cost of ownership must include HOA/condo fees, which can be substantial. When negotiating, consider seasonal lulls for potentially better deals, particularly between mid-August and early October.

[Seller‘s Playbook]

Sellers should prepare for a market eager for well-presented properties but mindful of insurance costs. Proper staging can highlight a home’s resilience to local weather conditions. Ensure all disclosure documents and HOA regulations are current and transparent, avoiding deal-killers like unresolved permit issues. Timing your sale with tourist season movement—especially in winter months—can maximize interest.

Wow, Mike promises two things right up front; upscale, concierge service and seven day a week availability. Mike delivered on both right from the very beginning. He took the time to understand what type of home I was looking for. When I wasn’t clear, he probed even deeper. The end result….when I saw listings, they were the ones that fit my criteria. We didn’t waste our time chasing around looking at homes that were of no value to me! Mike took the time to explain, right up front, how the buying process would work. He clearly knows his stuff! If you are looking for a Broker that understands his job and places his clients above all else, Mike is the one for you. I feel like I’ve not only found an exceptional broker but also a good friend.

– Sue Lear, Google Review

[Investment Angle]

Investment potential remains strong, especially in the short-term rental market. However, be aware of local rental restrictions and association rules, which can limit rental periods and frequency. ROI can be attractive, but investors must factor in higher insurance premiums and potential tax implications unique to Florida’s coastal properties.

[What’s Next]

Looking forward, potential policy changes in flood insurance and property tax legislation could influence timing and strategy. Stay informed on regulatory developments and market shifts by consulting local real estate professionals regularly. Their insights on infrastructure projects and tourism trends could offer timely advantages.

Pro Tips

- Verify flood zone classification with local agencies; it directly impacts insurance rates.

- Consider buying in the off-season to take advantage of less competition.

- Perform a wind mitigation inspection to potentially lower insurance premiums.

- Consult on bridge clearance restrictions when considering large vessels or sailboats.

Common Mistakes

- Ignoring flood and wind mitigation costs can lead to budget overruns.

- Overpricing in a niche market can prolong listing times—price correctly from the start.

- Failing to understand local rental restrictions can disrupt investment plans.

- Neglecting to update or disclose HOA compliance issues can derail sales.

Action Steps

- Schedule a consultation with a local real estate expert within the next two weeks.

- Obtain an elevation certificate and wind mitigation report before making an offer.

- Contact Team Renick to assess market trends and tailor your strategy accordingly.

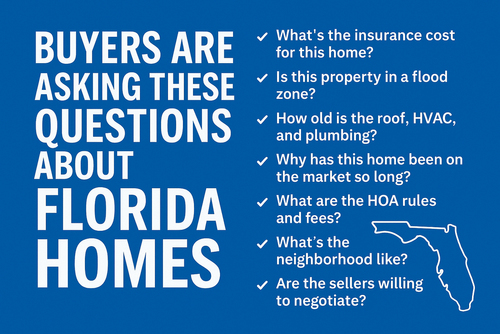

Frequently Asked Questions

- What impact does flood insurance have on buying property in Sarasota?

Flood insurance premiums can be significant, particularly in flood zones AE and VE. Understanding these costs is crucial to financial planning for homebuyers. - Are there restrictions on renting out my property on Longboat Key?

Yes, Longboat Key has specific rental regulations under HOA and condo rules. It’s important to review these before buying with investment in mind. - How do tourist seasons affect property prices on Siesta Key?

Tourist seasons can impact demand, driving prices higher in peak months. Consider buying during the off-season for potential savings. - What should a buyer consider about wind mitigation?

Wind mitigation features can lead to reduced insurance premiums. An inspection can identify areas for potential upgrades, benefiting long-term costs. - Can bridge restrictions affect property value on Anna Maria Island?

Yes, bridge limitations can impact accessibility and, therefore, property desirability, especially for boat owners. Consider this when evaluating location.

Call to Action

Call my cell: 941.400.8735. If you want straight answers—no hype—and a transparent approach, I’m here to help you evaluate your next move on Florida’s West Coast.

—

To learn more about Michael and Team Renick:

To search for local properties:

https://search.teamrenick.com/

To read more about what Michael shares with his clients: