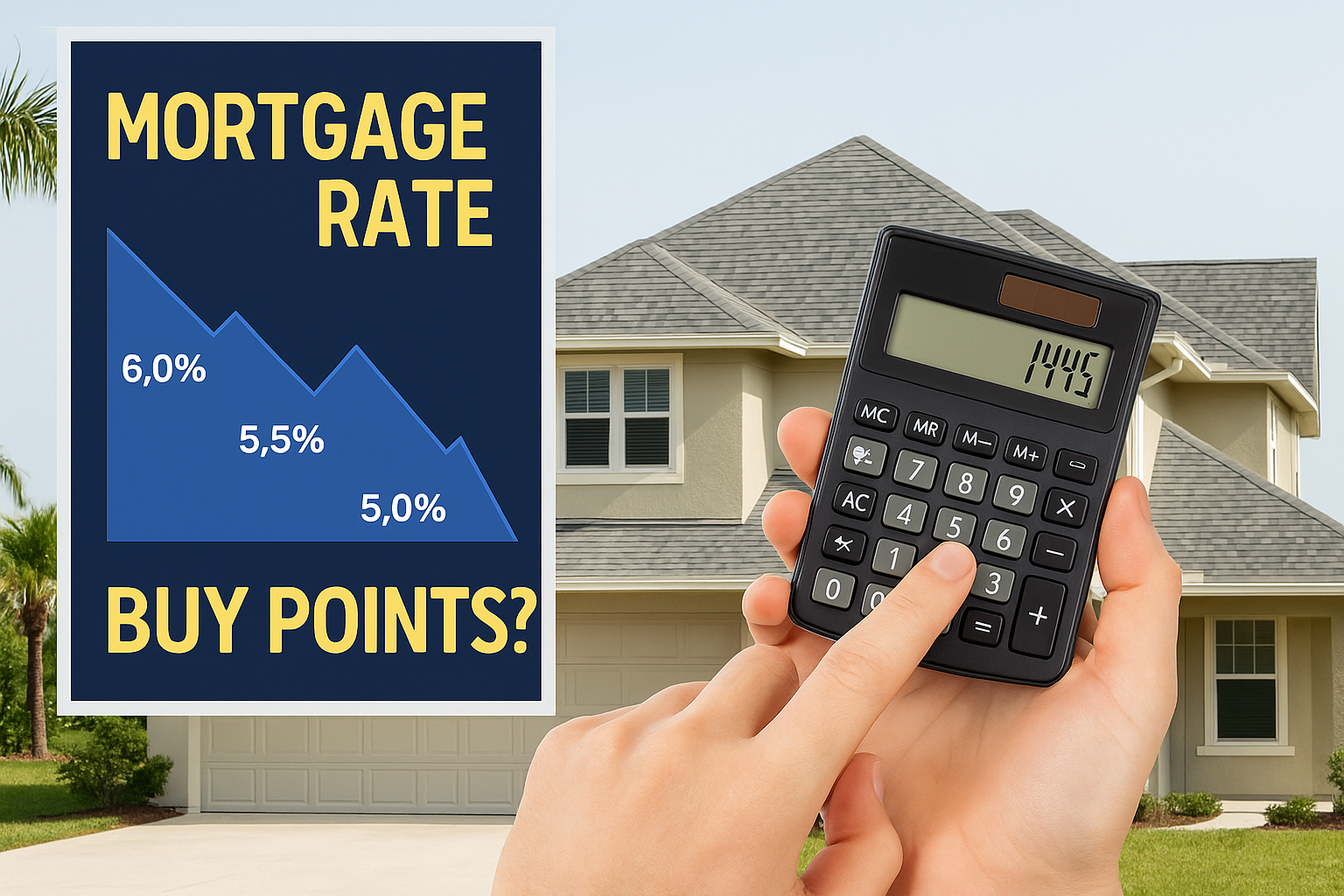

Florida Mortgage Points: Should You Buy Down Your Rate?

Florida Mortgage Points: Should You Buy Down Your Rate?

In a higher interest rate environment, some Florida buyers consider paying mortgage points to lower their interest rate.

But is it worth it?

Let’s break it down.

What Are Mortgage Points?

Mortgage points (also called discount points) are fees paid upfront to lower your loan’s interest rate.

- 1 point = 1% of your loan amount

- Each point typically lowers your rate by 0.25%

Example: 1 point on a $400,000 loan = $4,000 paid at closing

When Buying Points Makes Sense

- You plan to stay in the home long-term

- You want lower monthly payments

- You have extra cash available at closing

How to Calculate the Break-Even

Divide your upfront cost by monthly savings.

If it costs $4,000 and saves $100/month:

- Break-even = 40 months (just over 3 years)

- Stay longer than that? You win.

When NOT to Buy Points

- You’ll refinance or sell within 3–5 years

- You need that cash for moving, repairs, or reserves

- You’re already near the top of your monthly budget

Buying Points in Florida

Points are commonly used here due to:

- Higher loan balances

- Volatile interest rate shifts

- Cash-heavy buyers looking to optimize payments

Work with a local lender to compare rate sheets with and without points.

Final Thought

Mortgage points can be a smart move—or a costly one.

It all depends on how long you plan to stay.

📞 Call Michael Renick at 941.400.8735 to crunch the numbers and decide if buying points is right for your Florida home loan.

“Buying a Home in Florida: 15-Year or 30-Year Mortgage?”

📣 Let’s Talk Strategy

Want a clear breakdown of your numbers and a smarter way to sell? Let’s connect.

- 📞 Call Mike: 941.400.8735

- 📍 Explore our blog series: Questions Buyers Are Asking

- 🌐 Learn how we operate and why it matters: TeamRenick.com

- 🔎 Start your property search: Search.TeamRenick.com