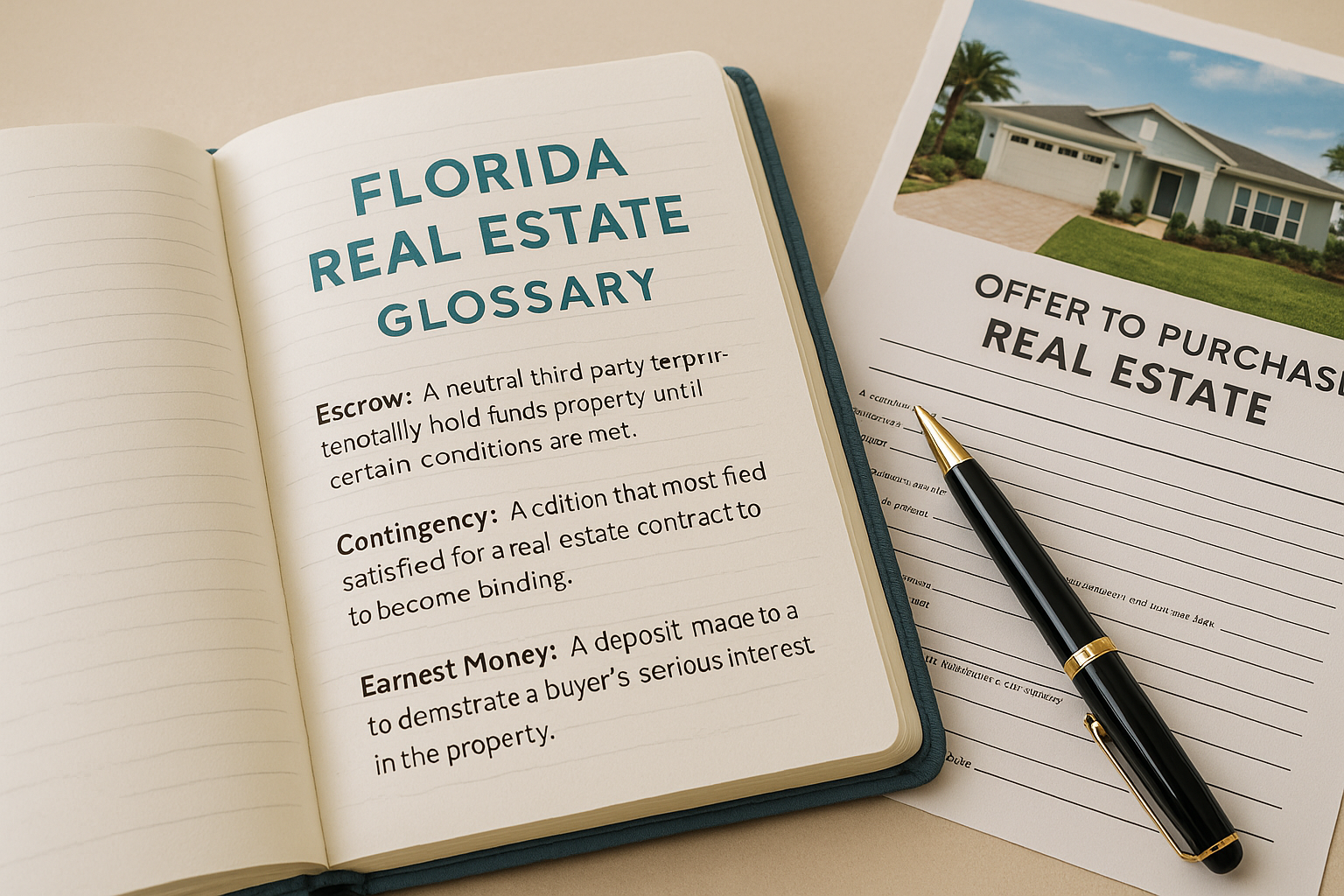

Florida Real Estate Terms Buyers Should Know Before Making an Offer

Florida Real Estate Terms Buyers Should Know Before Making an Offer

Florida real estate has its own lingo.

If you’re a buyer, these are the terms you need to know before making an offer.

1. Escrow

Money held by a neutral third party (like a title company) until closing.

Includes:

- Your earnest money deposit

- Sometimes property taxes or insurance premiums

2. Earnest Money

A deposit (usually 1-3% of purchase price) you submit with an offer to show good faith.

Goes toward closing costs or down payment.

If you break contract for no reason, you could forfeit it.

3. Contingency

A contract clause that allows you to cancel without penalty if certain conditions aren’t met.

Common contingencies:

- Financing

- Home inspection

- Appraisal

- Sale of your current home

4. Title Insurance

Protects you from legal issues tied to ownership of the home.

Lender’s policy is required. Buyer’s policy is optional but recommended in Florida.

5. Appraisal

An independent opinion of value, usually required by your lender.

If it comes in low, you may need to renegotiate or cover the gap.

6. Loan Estimate (LE)

A form your lender provides showing all projected costs.

Compare it to your Closing Disclosure later in the process.

7. Closing Disclosure (CD)

Final form with exact figures: loan amount, interest, taxes, fees, and cash to close.

You get it 3 days before signing.

8. Rate Lock

Secures your interest rate for a set time (usually 30-60 days).

Prevents surprise changes before closing.

Final Thought

The more you understand, the more confident you’ll be in Florida’s market.

📞 Call Michael Renick at 941.400.8735 to decode the fine print and make smarter real estate decisions.

What Florida Buyers Need to Know About the Closing Disclosure

📣 Let’s Talk Strategy

Want a clear breakdown of your numbers and a smarter way to sell? Let’s connect.

- 📞 Call Mike: 941.400.8735

- 📍 Explore our blog series: Questions Buyers Are Asking

- 🌐 Learn how we operate and why it matters: TeamRenick.com

- 🔎 Start your property search: Search.TeamRenick.com