Longboat Key: Predicting Future Home Values

Is Longboat Key Set for Value Growth in 2025?

Quick Answer

- Longboat Key‘s luxury market shows steady interest, driven by limited inventory and high demand for waterfront properties.

- Flood zone considerations (AE/VE) can affect insurance costs and resale value; research thoroughly.

- Connect with Michael Renick to evaluate property value trends specific to Longboat Key.

- Review local zoning permits and HOA rules to anticipate potential property improvements or restrictions.

- Consider proactive wind mitigation measures; they may lower insurance premiums and protect investment.

The Complete Picture

The allure of Longboat Key lies in its stunning beachfront properties and luxurious lifestyle. As we approach 2025, potential buyers and investors are eyeing this market for its potential growth. It’s crucial to understand the local dynamics that could influence property values, such as environmental factors, insurance changes, and the broader real estate market trends. This information is vital as it could mean the difference between a generational investment or an unexpected financial headache.

I’m a first time investor looking to buy a condo to ultimately rent out. I selected Mike to work with based on his profile. I admitted right up front that I was completely new to this process. Mike took his time and explained his approach to real estate investing. He not only helped me best understand how to look for a good return, he reminded me that up side price appreciation would be the icing on the cake. To make a long story short, we submitted our first offer about an hour ago. Based on the analysis we completed together, I feel very good about the possible purchase. No matter how this turns out, I have learned a lot from Mike. I know that we are going to get this done together. TH

– tonyhamptner, Zillow Review

Market Reality

Currently, Longboat Key is experiencing a moderate increase in property demand, partly due to its reputation as a high-end location. As of late 2023, home prices ranged from $1.2 to $5 million, with luxury waterfront properties often demanding even higher premiums. The average days on market (DOM) for properties in this area typically hover around 60-90 days, reflective of the area’s exclusivity. However, potential buyers must keep a keen eye on insurance pressures as flood zones, such as AE and VE, might dramatically impact ownership costs due to higher premiums and stricter underwriting standards.

Local Insights

Longboat Key boasts notable neighborhoods such as Country Club Shores and Bay Isles, each offering distinct lifestyle benefits. Buyers must weigh trade-offs such as bridge traffic during peak season and the implications of local seawall and bridge clearance requirements. Additionally, residents frequently face certain condo association realities, including assessment fees and budget mandates that can affect monthly costs and long-term property value.

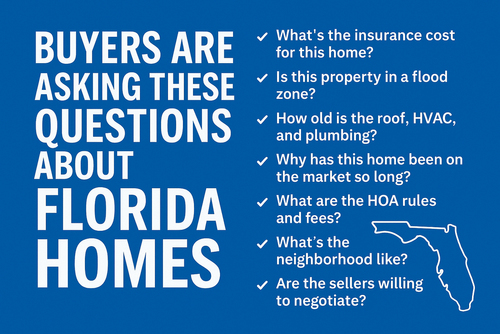

Buyer‘s Guide

Financing luxury properties on Longboat Key requires careful consideration of distinct factors like flood insurance, which could influence loan approval processes. Buyers should negotiate contingencies related to potential sea-level changes or adverse weather. Inspections should focus on seawall integrity and roof conditions, given the coastal exposure. Buyers must budget for HOA fees, which can range significantly based on amenities and property type.

We recently closed on our dream home due to Eric Teoh’s market knowledge and expertise. His grasp of the market and his hands on approach were instrumental to our successful purchase. Eric had remarkable market information available at a moment’s notice. He skillfully assisted us in preparing our strategy. He interfaced with our seller, assisting while remaining professional. I wholeheartedly recommend Eric Teoh as a valuable resource in any Sarasota real estate transaction.

– N Isaacson, Google Review

Seller‘s Playbook

For sellers, presenting a competitively priced property requires understanding recent market trends and setting realistic expectations. Pre-listing inspections should address potential deal-breakers, such as outdated wind mitigation features. Additionally, sellers should prioritize staging to enhance the property’s unique attributes, which can be instrumental in elevating perceived value. It’s also crucial to provide full disclosure of association documents to mitigate potential buyer apprehensiveness.