Manatee County Real Esate Deep Dive: August 24, 2025

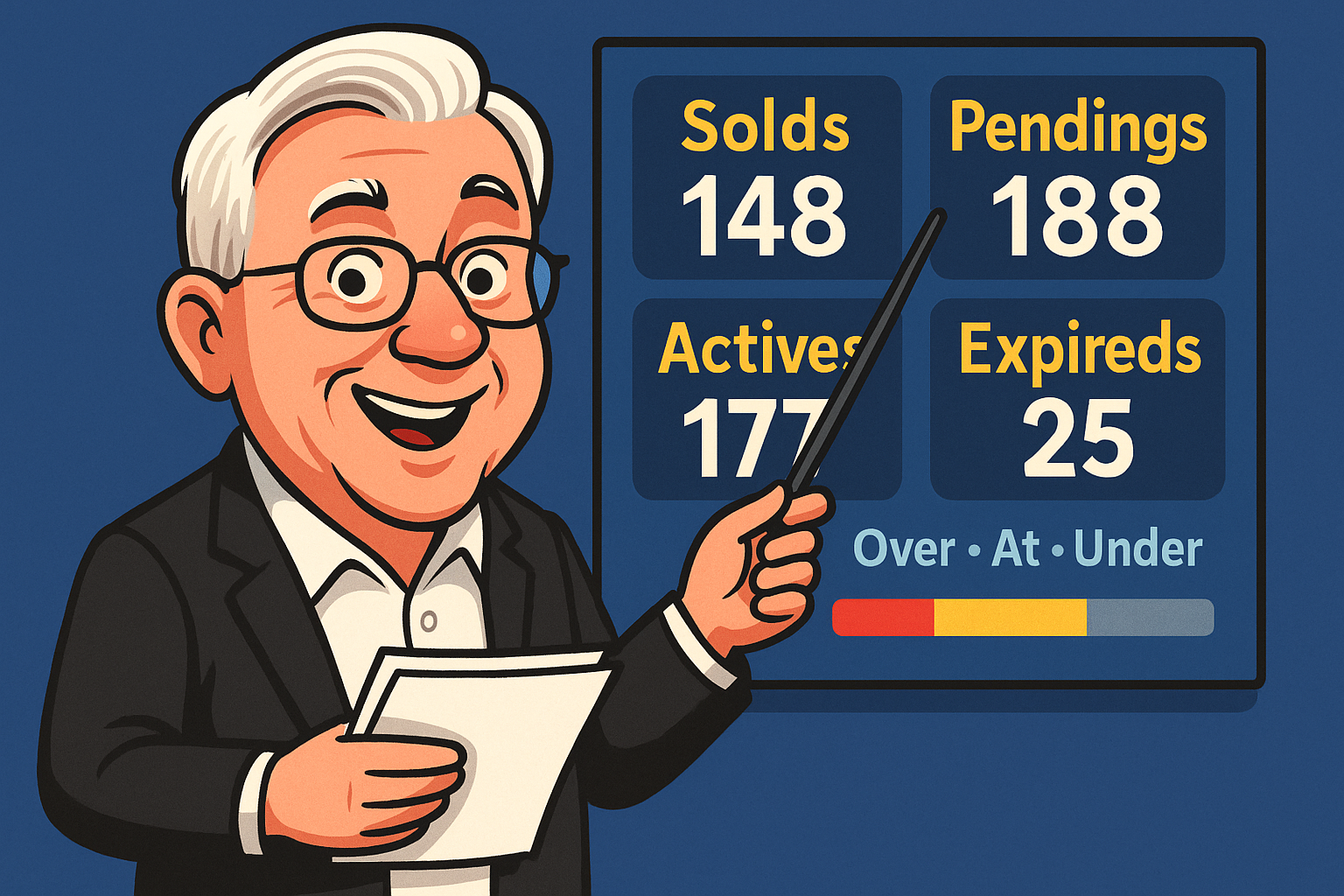

Closings Aug 18–22, 2025 • Pendings/Actives from same MLS export

Local Knowledge Broker Report

We surface the moves other analysts miss—so you can price, position, and negotiate with confidence.

It’s an “At‑List,” not “Over‑Ask,” market

Over • At • Under

“Now vs Later” Market

Condos drag; Townhomes sprint

Townhomes: ~25 days, ~0.99 SP/LP.

Single‑family: ~53 CDOM, ~0.98 SP/LP.

- Palmetto (solds): fastest ~19 days, ~0.99 SP/LP.

- Parrish (solds): 50% at‑list • ~0.995 SP/LP.

- Bradenton (solds): ~0.96 SP/LP → expect negotiation.

Split personality: ~23% under 2 weeks; ~50% 120+ days.

These mark the price/condition lines the market rejected.

Luxury brakes vs entry resilience

- ≤$426k: Ask is above last week’s sold by $25–$28/sf.

- ≥$630k: Active asks are below last sold by ~$22/sf (pre‑cut luxury).

- Top tier solds: CDOM ~103, SP/LP ~0.955.

Premium & penalty

- Private pool: high $/sf (~$342) but slow (~92 days) and discounted (SP/LP ~0.95).

- No pool: fast (~20 days), tight (SP/LP ~0.995).

- Community pool: middle of the pack.

Myth‑buster

- Cash share: ~37% of closings.

- FHA: ~0.995 SP/LP • VA: ~1.00 → outperformed Cash (~0.97).

- Sellers (Luxury): Price to today’s comps; buyers are already anchored lower (active ask < last sold).

- Sellers (Entry/Mid): Expect list‑to‑sell compression; win with condition and timing to hit the “at‑list” pocket.

- Condo Sellers: Lead with price realism + carrying‑cost story to overcome ~130‑day hesitation.

- Buyers: Don’t auto‑prefer cash—FHA/VA bids are winning on price capture this week.

- Lakewood Ranch: Micro‑target by plan/finish/size; it’s either sprint or marathon—rarely average.

Scope: Weekly MLS export; same dataset for closings, pendings, actives, expireds.