Manatee County Housing Update Nov 30–Dec 6

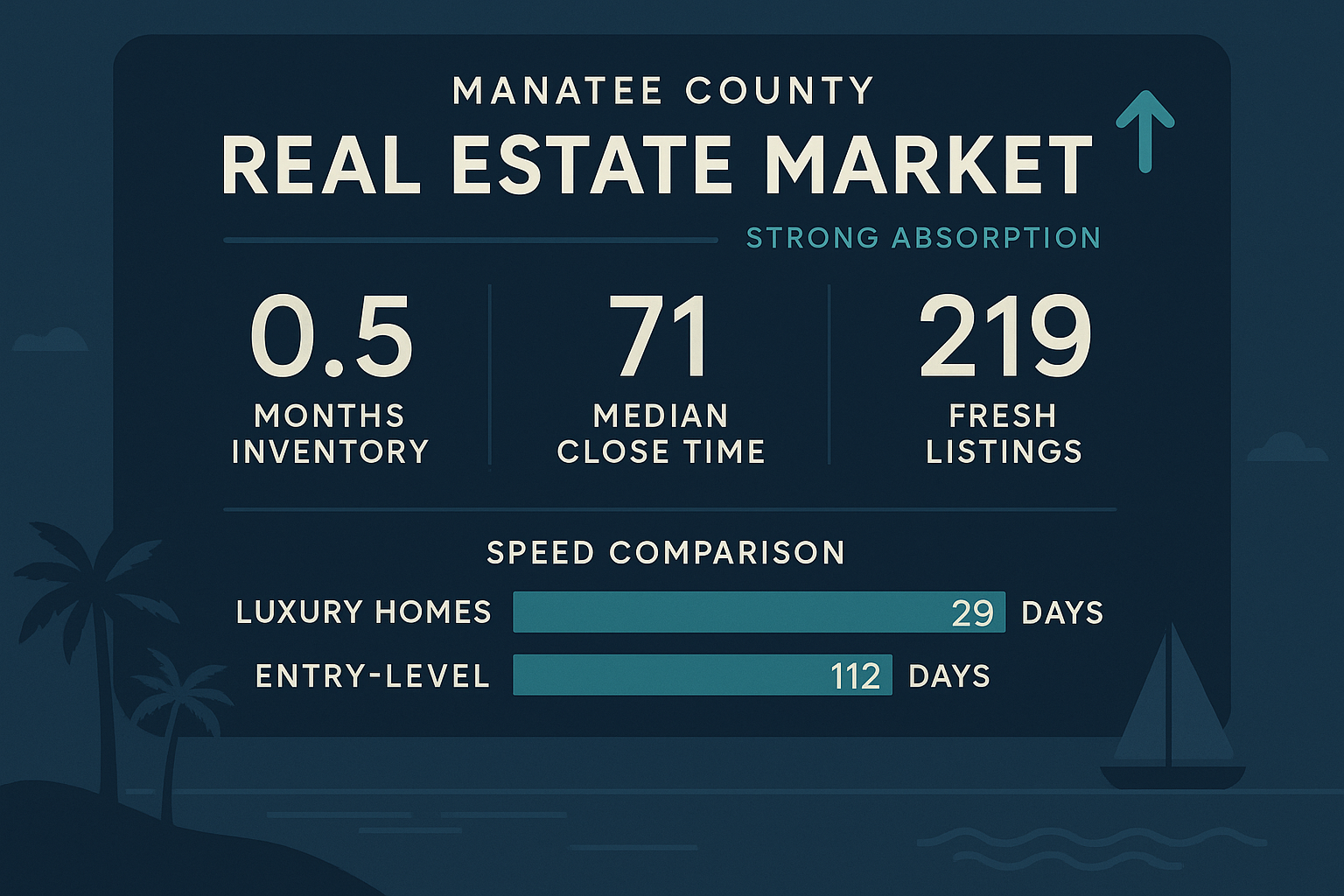

Manatee County Market Snapshot: November 30 – December 6: Fresh Inventory Surge with 52.5-Day Median Close Times

Analysis of 279 active, 152 pending, and 176 closed listings showing exceptional inventory freshness with 89% of active listings under 7 days.

Market Snapshot: Fresh inventory surge drives balanced absorption with 52.5-day median close times and minimal stale inventory.

All records analyzed

Segment Performance (Overall)

Price Bands

Luxury entry properties (750K-1M) demonstrate exceptional velocity at 32 days median DOM, significantly outperforming the overall market. Mid-tier properties (250-500K) close in 57 days with strong volume of 79 transactions. Upper-mid segment (500-750K) shows competitive 48-day performance. Super-luxury properties (2M+) require extended 172.5 days, reflecting typical high-end market dynamics. Entry-level homes under 250K close in 43.5 days with moderate volume.

Geography (Cities/Zips)

Longboat Key leads with exceptional 8-day median DOM, significantly faster than the market average. Parrish and Palmetto show competitive performance at 42 and 45 days respectively. Bradenton, the largest market with 80 closings, maintains steady 52.5-day velocity. Lakewood Ranch shows slower absorption at 68 days despite premium pricing. Anna Maria represents an outlier with 527 days for ultra-luxury properties. Geographic performance correlates with property type mix and price positioning.

Property Types

Single-family residences dominate with 130 closings at 50 days median DOM and $506,250 median price. Condominiums show faster velocity at 46 days with 29 closings at $320,000 median. Townhouses require longer absorption at 84.5 days with 8 closings. Villas close in 64 days with moderate activity. Property type performance reflects buyer preferences and inventory availability across segments.

Segment Performance — Single-Family

Price Bands

Single-family luxury entry properties (750K-1M) lead with 33.5 days median DOM, demonstrating strong buyer demand. Upper-mid segment (500-750K) shows competitive 45-day performance with 40 closings. Mid-tier properties (250-500K) represent the largest volume with 58 closings at 55 days. Entry-level single-family homes under 250K close quickly at 15 days but with limited volume of 5 transactions. Super-luxury single-family properties require extended 172.5 days for absorption.

Geography (Cities/Zips)

Sarasota single-family homes show exceptional velocity at 31.5 days median DOM with premium pricing. Palmetto demonstrates competitive 37.5-day performance. Parrish maintains steady 42-day absorption with strong volume of 31 closings. Bradenton, the dominant market with 55 closings, shows 52-day performance. Lakewood Ranch single-family properties require 48 days despite premium positioning. Geographic variations reflect local market dynamics and buyer preferences.

Property Types

Single-family residences represent the entire segment with 130 closings at 50 days median DOM and $506,250 median price. The category shows consistent performance across the market with strong buyer demand and steady absorption patterns.

Segment Performance — Condo/Townhome/Villa

Price Bands

Luxury entry condos/townhomes/villas (750K-1M) demonstrate exceptional velocity at 8 days median DOM with limited volume. Mid-tier properties (250-500K) show extended 74-day absorption with 21 closings. Entry-level units under 250K close in 46 days with strong volume of 15 transactions. Upper-mid segment (500-750K) requires 63 days for absorption. The category shows varied performance across price segments with luxury units moving significantly faster.

Geography (Cities/Zips)

Longboat Key condos/townhomes/villas lead with exceptional 4-day median DOM, significantly outperforming all other areas. Parrish shows competitive 39-day performance with moderate volume. Sarasota and Bradenton demonstrate steady absorption at 46 and 65 days respectively. Lakewood Ranch requires extended 80 days for this property category. Geographic performance varies significantly, reflecting local market conditions and property positioning.

Property Types

Condominiums lead with 46 days median DOM and 29 closings at $320,000 median price. Villas require 64 days with 8 closings at $343,250 median. Townhouses show extended 84.5-day absorption with 8 closings at $282,000 median. Property type performance reflects buyer preferences within the alternative housing category, with condos demonstrating strongest velocity.

Actionable Playbook

- Sellers: Capitalize on fresh inventory momentum by pricing competitively in the luxury entry segment (750K-1M) where properties close in 32 days.

- Buyers: Focus on Longboat Key for fastest closings at 8 days, or consider Parrish and Palmetto for competitive 42-45 day timelines with strong value.

- Investors: Target entry-level properties under 250K with 43.5-day absorption and condominiums with 46-day velocity for optimal turnover.

- Monitor geographic variations as Lakewood Ranch shows extended timelines despite premium positioning, while coastal areas demonstrate exceptional velocity.

DOM Basis: CDOM

Notes: Pending-date coverage low (0%); strict in-window pending subset not used.

Period: November 30 – December 6, 2025