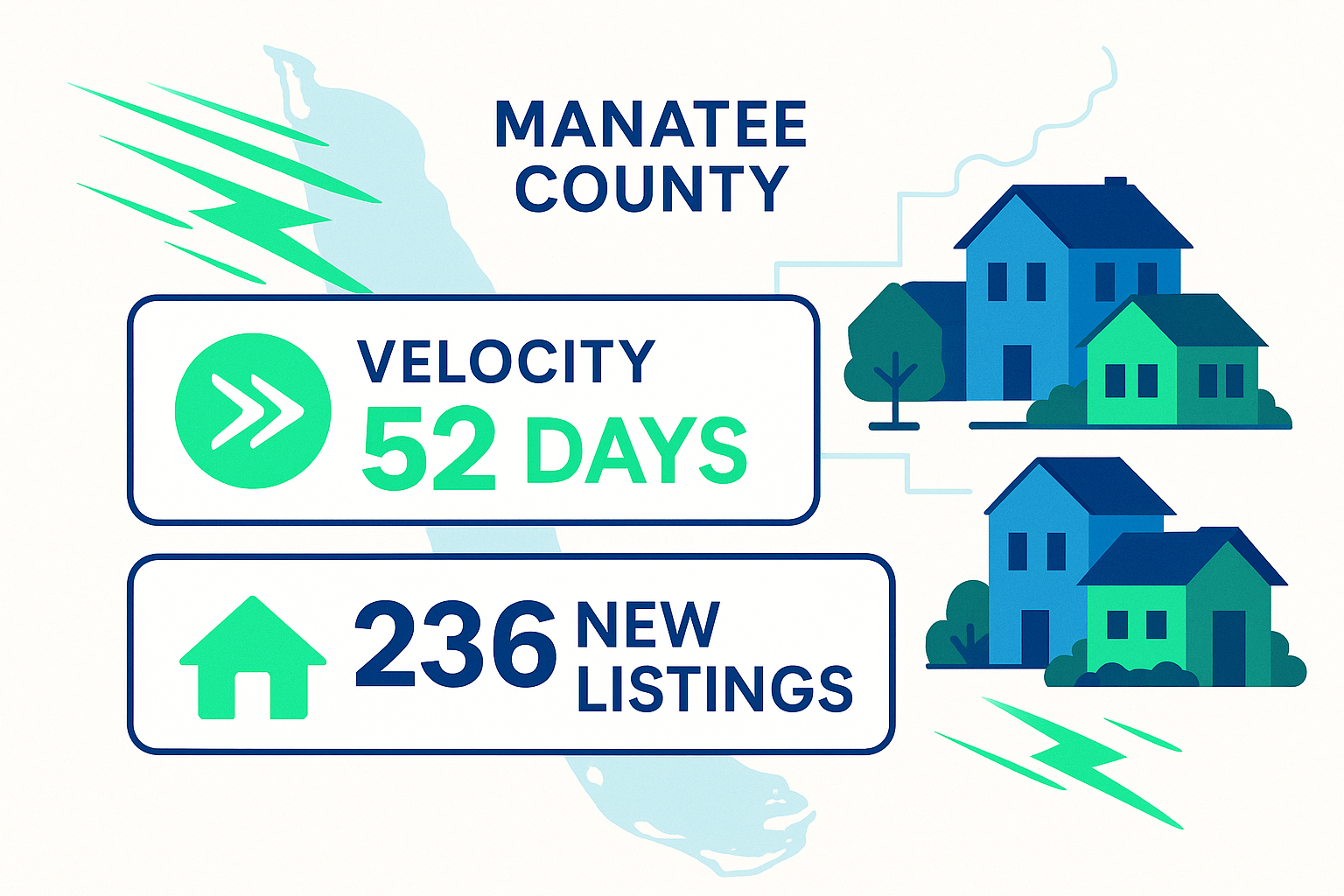

Manatee County Housing Data: Oct 26–Nov 1

Manatee County Market Snapshot: October 22 – November 1, 2025: Strong Absorption with 55-Day Median Close Times

Analysis of 248 active, 188 pending, and 193 closed listings showing exceptional absorption with 0.3 months of inventory.

Market Snapshot: Strong buyer demand drives 0.76 PAR with significant property type velocity differences.

All records analyzed

Segment Performance (Overall)

Price Bands

Luxury entry properties ($750K-$1M) demonstrate exceptional velocity at 23.5 days, significantly faster than entry-level homes at 73.5 days. Mid-tier properties ($250K-$500K) close in 55.5 days with the highest volume of 116 transactions. Super-luxury properties ($2M+) show remarkable speed at just 5 days, though with limited volume of 3 sales.

Geography (Cities/Zips)

Palmetto leads market velocity at 29 days median close time, while Longboat Key requires 168 days. Parrish and Bradenton show balanced performance at 49.5 and 58.5 days respectively. Lakewood Ranch takes 81.5 days despite higher median prices. Beach communities show mixed results with Anna Maria at 5 days versus Longboat Key’s extended timeline.

Property Types

Single-family residences dominate with 154 closings in 50 days. Townhouses match this velocity at 50 days with 13 sales. Villas require significantly longer at 116.5 days for 14 transactions. Condominiums show the slowest performance at 157.5 days with 12 closings, indicating distinct market dynamics for attached housing.

Segment Performance — Single-Family

Price Bands

Single-family luxury entry properties ($750K-$1M) close in 23.5 days, demonstrating premium market efficiency. Entry-level single-family homes close remarkably fast at 11 days, though with limited volume. Mid-tier properties maintain steady 51-day performance with 84 transactions representing the market’s core activity.

Geography (Cities/Zips)

Palmetto single-family homes lead at 24 days, followed by Bradenton at 39 days. Parrish maintains 50-day performance with strong volume. Lakewood Ranch single-family properties take 69 days despite premium pricing. Longboat Key single-family homes require 168 days, consistent with overall market patterns in that luxury coastal area.

Property Types

Single-family residences represent the entire category with 154 closings at 50 days median DOM, maintaining consistent performance across the segment with a strong 0.8 PAR and healthy absorption metrics.

Segment Performance — Condo/Townhome/Villa

Price Bands

Entry-level attached housing under $250K requires 109 days with 7 transactions. Mid-tier properties ($250K-$500K) take 91 days for 32 closings, representing the majority of this segment’s activity. Higher price bands show limited activity in the attached housing category.

Geography (Cities/Zips)

Parrish attached housing performs best at 33 days, while Bradenton requires 132 days and Lakewood Ranch takes 135 days. Palmetto shows extended timelines at 237.5 days for attached properties, contrasting sharply with its single-family performance.

Property Types

Townhouses perform best at 50 days with 13 closings. Villas require 116.5 days for 14 transactions. Condominiums show the longest timeline at 157.5 days with 12 closings, indicating distinct buyer preferences and financing considerations for this property type.

Actionable Playbook

- Sellers: Single-family properties offer fastest liquidity at 50 days; avoid condominiums if speed is priority as they require 157.5 days.

- Buyers: Focus on Palmetto for quickest closings at 29 days; luxury entry tier ($750K-$1M) provides premium properties with exceptional 23.5-day velocity.

- Investors: Target single-family segment with 0.8 PAR and 0.3 MOI indicating strong rental demand and quick turnover potential.

- Consider geographic arbitrage between Palmetto’s 29-day performance versus Longboat Key’s 168-day timeline for strategic positioning.

DOM Basis: CDOM

Notes: Pending-date coverage low (0%); strict in-window pending subset not used.

Period: October 25, 2025 – October 31, 2025