Manatee County Market Snapshot: October 12 – 18, 2025

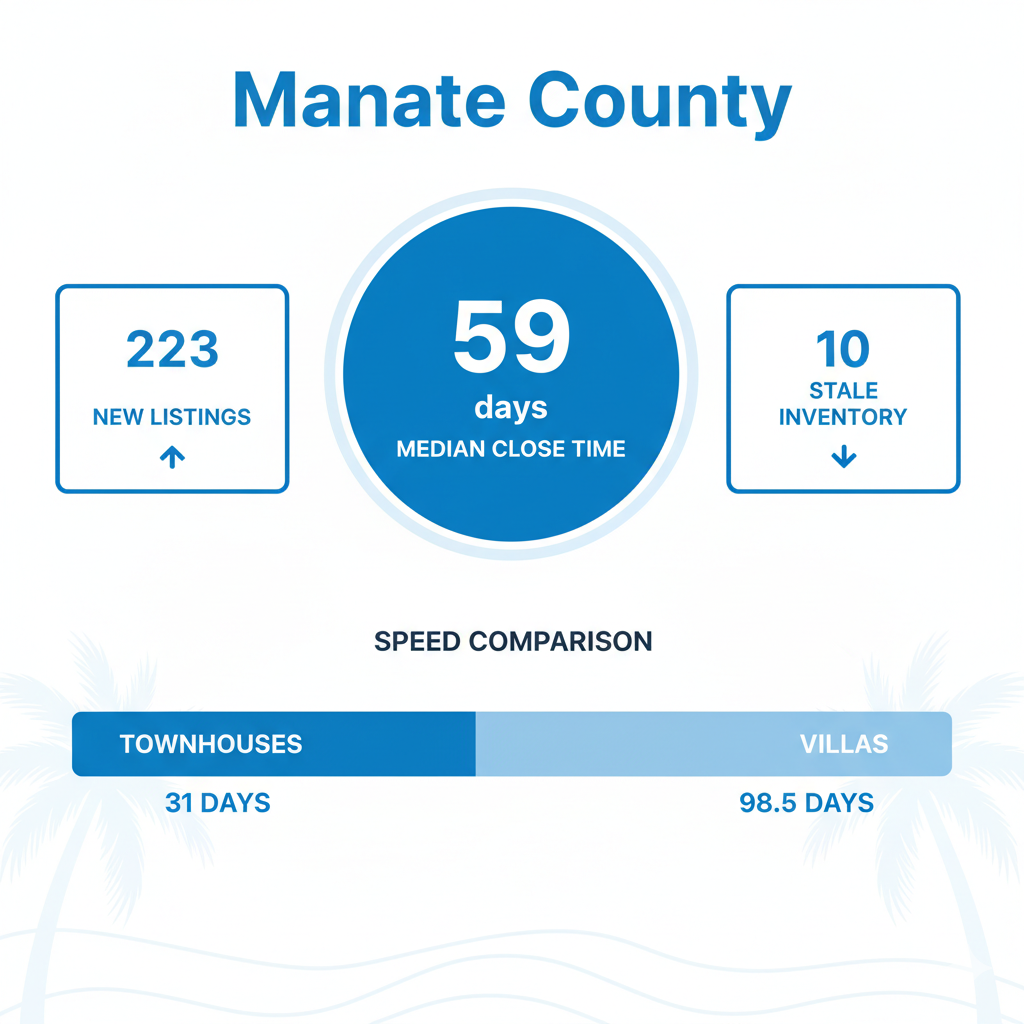

Manatee County Market Snapshot: October 12 – 18, 2025: Two-Speed Market with Single-Family Homes Closing Nearly Twice as Fast

Analysis of 230 active, 336 pending, and 150 closed listings showing pronounced two-speed dynamics with single-family homes significantly outpacing alternative property types.

Market Snapshot: Single-family homes close in 61 days while condos require 119 days, creating a dramatic two-speed market with nearly 2x performance difference.

All records analyzed

Segment Performance (Overall)

Price Bands

Price band performance shows an interesting inversion pattern in the luxury segment. Mid-range properties ($250-500K) close in 61 days with 80 sales, while upper-mid properties ($500-750K) take 84 days with 42 sales. The luxury segment ($1-1.5M) shows significantly extended timelines at 168 days with 7 sales, while super-luxury properties ($2M+) close faster at 84 days with 2 sales. Entry-level properties under $250K close in 56 days with 9 sales, showing competitive performance despite lower price points.

Geography (Cities/Zips)

Geographic performance varies dramatically across Manatee County. Lakewood Ranch leads with 30-day median close times and $618,783 median prices across 19 sales. Palmetto follows at 48 days with $410,990 median prices and 17 sales. Sarasota shows 40-day close times with $460,000 median prices but only 7 sales. Parrish significantly underperforms at 88 days despite competitive $404,495 median prices across 48 sales. Bradenton shows 71-day close times with $440,000 median prices and 51 sales, representing the largest volume market.

Property Types

Property type performance reveals stark differences in market velocity. Single-family residences dominate with 123 sales, $479,000 median prices, and 61-day close times. Condominiums show 15 sales at $236,000 median prices but require 119 days to close. Townhouses take 134 days with $290,000 median prices across 5 sales. Villas close in 95 days with $425,000 median prices and 7 sales. The data clearly shows single-family homes moving nearly twice as fast as alternative property types.

Segment Performance — Single-Family

Price Bands

Single-family price bands show strong performance in mid-range segments. The $250-500K band leads with 67 sales closing in 47 days at $386,020 median prices. Upper-mid properties ($500-750K) show 38 sales closing in 71 days at $590,500 median prices. Luxury entry ($750K-1M) demonstrates 9 sales closing in 64 days at $820,000 median prices. The luxury segment ($1-1.5M) shows extended 168-day close times with $1,220,000 median prices across 7 sales. Super-luxury properties ($2M+) close in 84 days with $3,537,500 median prices and 2 sales.

Geography (Cities/Zips)

Single-family geographic performance shows Lakewood Ranch leading at 31-day close times with $619,392 median prices across 18 sales. Palmetto follows at 31 days with $402,490 median prices and 14 sales. Sarasota shows 40-day close times with $522,500 median prices but only 5 sales. Parrish underperforms at 87 days despite $429,900 median prices across 45 sales. Bradenton shows 64-day close times with $500,000 median prices and 35 sales, representing significant volume in the single-family segment.

Property Types

Single-family residences represent the entire category with 123 sales, $479,000 median prices, and 61-day close times. This segment shows strong absorption metrics with 1.56 PAR and 0.3 months of inventory, indicating robust demand conditions and efficient market clearing.

Segment Performance — Condo/Townhome/Villa

Price Bands

Condo/townhome/villa price bands show extended marketing periods across all segments. Entry-level properties under $250K close in 56 days with $170,000 median prices across 9 sales. Mid-range properties ($250-500K) require 102 days with $356,000 median prices and 13 sales. Upper-mid properties ($500-750K) take 135 days with $615,000 median prices across 4 sales. Luxury entry properties ($750K-1M) show 157 days with $785,000 median prices and 1 sale, indicating limited activity in higher price ranges for this property category.

Geography (Cities/Zips)

Condo/townhome/villa geographic performance shows Lakewood Ranch with the fastest 30-day close time but only 1 sale at $321,990. Bradenton leads in volume with 16 sales closing in 95 days at $309,000 median prices. Palmetto shows 119 days with $480,000 median prices across 3 sales. Parrish requires 134 days with $280,000 median prices and 3 sales. Sarasota shows 120 days with $180,000 median prices across 2 sales, indicating limited activity in this property category across most geographic areas.

Property Types

Property type breakdown shows condominiums with 15 sales closing in 119 days at $236,000 median prices. Townhouses require 134 days with $290,000 median prices across 5 sales. Villas close in 95 days with $425,000 median prices and 7 sales. All property types in this category show significantly extended marketing periods compared to single-family homes, with absorption metrics of 1.2 PAR and 0.6 months of inventory indicating slower market clearing.

Two-Speed Market

The market shows a pronounced two-speed dynamic with single-family homes closing in 61 days compared to 119 days for condos, townhomes, and villas – a 95% speed difference. Active inventory shows similar patterns with single-family homes at 3-day median active DOM versus 3.5 days for alternative property types. This 58-day gap in closed DOM significantly exceeds the 30-day threshold, indicating distinct market segments operating at fundamentally different velocities.

Actionable Playbook

- Sellers: Single-family properties in Lakewood Ranch and Palmetto offer fastest liquidity at 30-31 days, while condo sellers should expect 119+ day marketing periods and price accordingly.

- Buyers: Strong negotiating position in condo/townhome/villa segment with extended DOM, while single-family homes require quick decisions in competitive 61-day average market.

- Investors: Focus on single-family properties for faster turnover and stronger absorption metrics (1.56 PAR vs 1.2 PAR), particularly in Lakewood Ranch and Palmetto markets.

- Monitor luxury segment inversion where $2M+ properties close faster than $1-1.5M range, suggesting pricing strategy opportunities in ultra-high-end market.

DOM Basis: CDOM

Notes: Pending-date coverage low (0%); strict in-window pending subset not used.

Period: October 12-18, 2025