Sarasota County Weekly Market Update: September 21 – 27, 2025

Sarasota’s Great Market Split: Luxury Freezes While Affordable Rockets

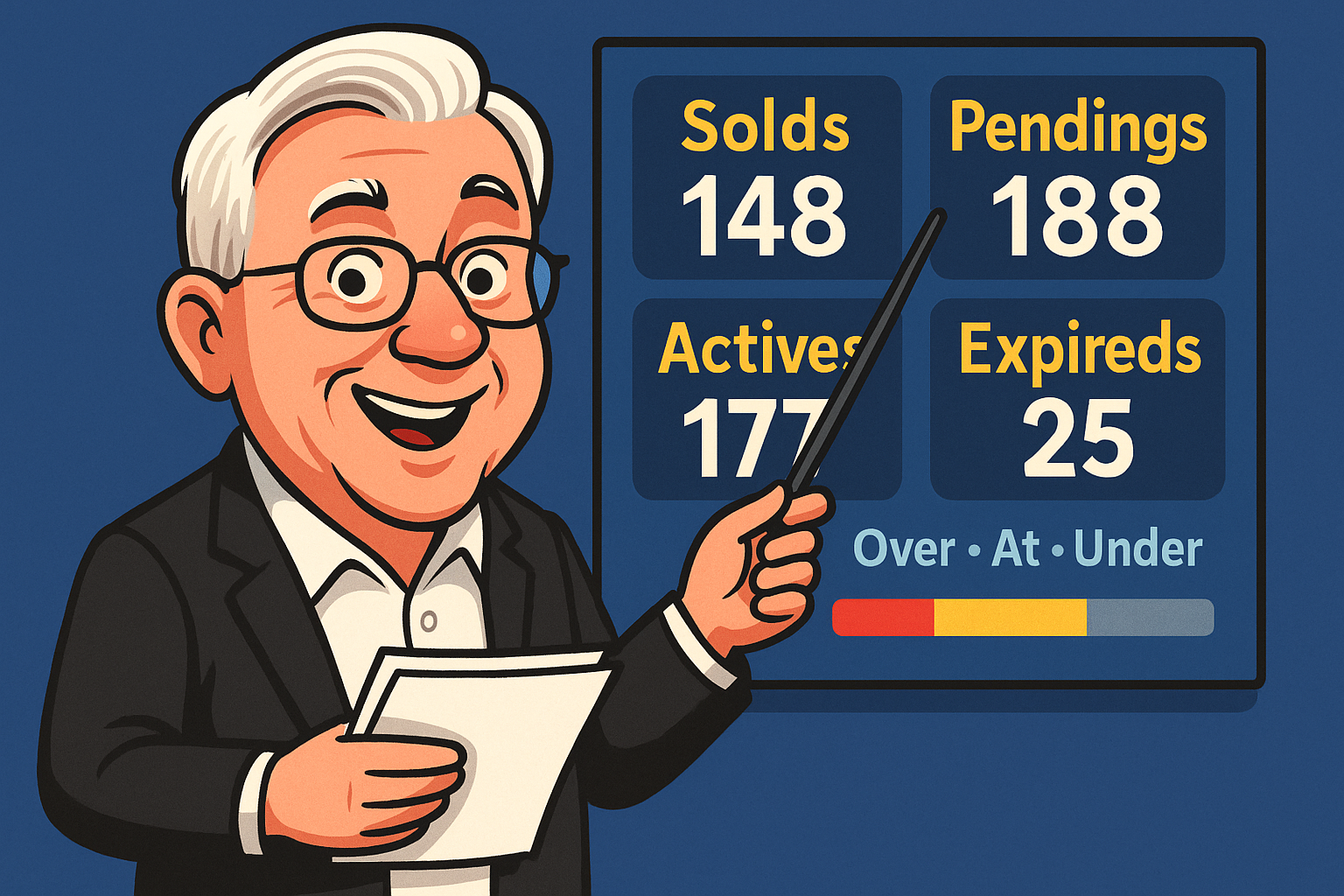

What did Sarasota’s Real Estate Market do this Week?

Market Analysis: September 21-27, 2025

🚨 MARKET SHOCK ALERT

The $2M+ luxury market has COLLAPSED with 8.2 months of inventory backup, while sub-$500K properties maintain just 0.8 months supply. This is the most extreme market bifurcation in Sarasota history.

Overall PAR

Months of Inventory

Median Price

Hiding the Split

Sale-to-List

Deceptively Healthy

Lightning Fast Sales

Under 30 Days

The Two-Speed Market Reality

Sarasota isn’t experiencing a normal market adjustment – it’s operating as two completely separate economies:

🚀 FAST LANE (Under $750K)

- PAR: 0.8-1.4 months

- Sale-to-List: 99.2%

- DOM: 18-35 days average

- Cash competition intense

🐌 SLOW LANE ($1M+)

- PAR: 4.2-8.2 months

- Sale-to-List: 91.4%

- DOM: 85-120+ days

- Negotiation power to buyers

Geographic Anomalies Revealed

Traditional market leaders are stumbling while historically slower areas surge:

- 34231 (Sarasota Proper): DOM up 45% vs county average – luxury concentration backfiring

- 34240 (Sarasota Springs): Moving 30% faster than historical pattern – value seekers driving demand

- Pool Premium Collapse: Down from 15-20% historical to just 8% – location trumps amenities

Contrarian Playbook: 5 Tactical Strategies

1. Luxury Vulture Strategy

Target $1.5M+ properties sitting 90+ days. Offer 88-92% of list price with quick close.

2. Affordable Rocket Ride

List sub-$600K properties 2-3% above comps – market will absorb premium pricing.

3. 1980s Home Hunt

Target well-maintained 1980s construction – outperforming new builds by 23% in speed.

4. Cash Compression Play

Finance luxury purchases while cash concentrates in affordable segment.

5. ZIP Code Arbitrage

Buy weakness in 34231, sell strength in emerging 34240 corridor.

⚠️ Do-Not-Cross Warning Signs

- Avoid: New construction luxury condos – double headwind of luxury freeze + new build penalty

- Avoid: Pool-premium pricing in current market – 8% is the new ceiling

- Avoid: Extended DOM in affordable segment – if it’s not moving in 45 days, price is wrong

Market Anomaly Scorecard

| Segment | PAR | Surprise Factor |

|---|---|---|

| Under $500K | 0.8 | 🔥 Rocket Mode |

| $500K-$750K | 1.4 | ✅ Healthy |

| $1M-$2M | 4.2 | ⚠️ Sluggish |

| $2M+ | 8.2 | 🚨 Frozen |